For the 24 hours to 23:00 GMT, the GBP declined 0.45% against the USD and closed at 1.3158.

In the Asian session, at GMT0300, the pair is trading at 1.3189, with the GBP trading 0.24% higher against the USD from yesterday’s close.

Overnight data indicated that, UK’s Gfk consumer confidence index fell more-than-expected to a level of -12.0 in July, falling by the most since 1990, thus indicating that sentiment among British households was affected badly as uncertainty spurred after the historic Brexit vote. The index had registered a reading of -1.0 in the prior month while markets expected it to fall to a level of -8.0. Additionally, the nation’s seasonally adjusted house prices unexpectedly climbed by 0.5% MoM in July, compared to market expectations for a flat reading and after recording a rise of 0.2% in the prior month.

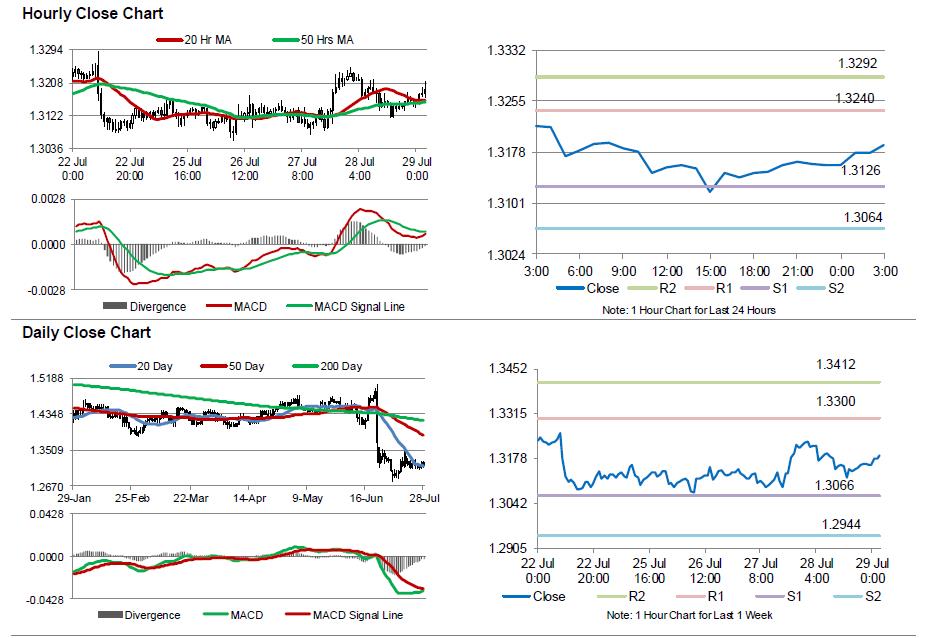

The pair is expected to find support at 1.3126, and a fall through could take it to the next support level of 1.3064. The pair is expected to find its first resistance at 1.324, and a rise through could take it to the next resistance level of 1.3292.

Moving ahead, UK’s mortgage approvals and consumer credit data, both for June, scheduled to release in a few hours, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.