For the 24 hours to 23:00 GMT, the USD declined 0.32% against the JPY and closed at 104.8.

In the Asian session, at GMT0300, the pair is trading at 104.66, with the USD trading 0.13% lower from yesterday’s close.

Earlier today, the Bank of Japan (BoJ) held its key interest rate steady at -0.1% and maintained its monetary base at an annual pace of ¥80 trillion. Nevertheless, the central bank eased its monetary policy further by increasing its buying of exchange-traded funds (ETF) to ¥6.0 trillion from ¥3.3 trillion.

The Japanese Yen gained ground, after overnight data indicated that Japan’s unemployment rate fell unexpectedly to a 21-year low level of 3.1% in June, pointing towards growth in the nation’s labour market. Markets expected the unemployment rate to remain steady at previous month’s reading of 3.2%. Additionally, the nation’s industrial production rebounded more-than-expected by 1.9% MoM in June, indicating that the nation’s industrial sector is regaining momentum. Markets expected it to rise by 0.5%, compared to a fall of 2.6% in the prior month. On the other hand, the nation’s annual consumer price index (CPI) fell by 0.4% in June, at par with market expectations and following a similar drop in the previous month, thus piling pressure on the BoJ to expand an already massive stimulus programme. Moreover, household spending eased by 2.2% on an annual basis in June, higher than market expectations for a drop of 0.4% and after recording a decline of 1.1% in the previous month. Further, the nation’s housing starts dropped less-than-expected by 2.5% YoY in June, following a gain of 9.8% in the preceding month.

Meanwhile, the BoJ’s quarterly outlook report revealed that the Japanese economy is likely to expand at a moderate pace and also indicated that there is strong uncertainty on timing of inflation to hit 2.0% target, mainly due to overseas risks. The central bank expects it to achieve the target by 2017.

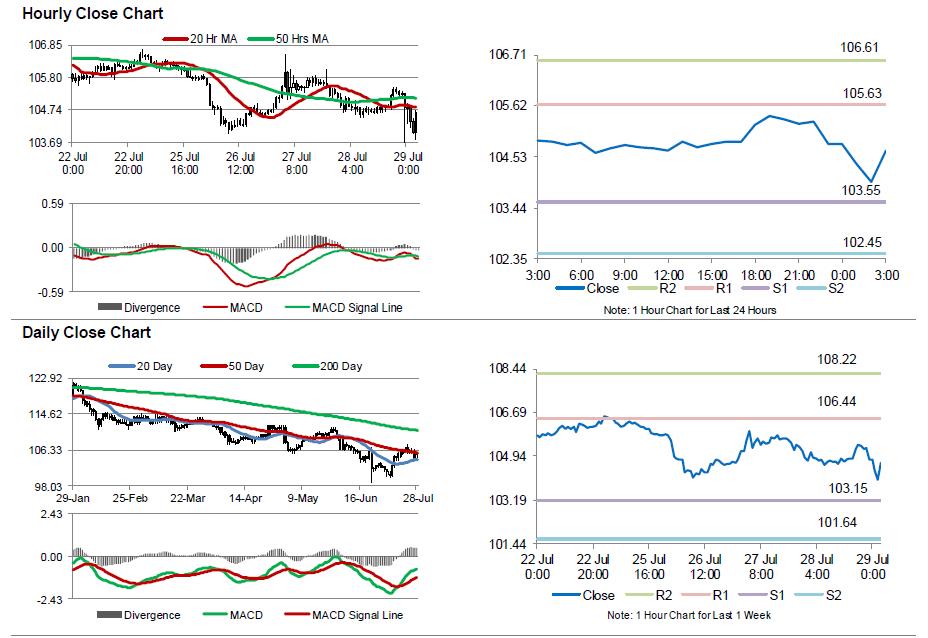

The pair is expected to find support at 103.55, and a fall through could take it to the next support level of 102.45. The pair is expected to find its first resistance at 105.63, and a rise through could take it to the next resistance level of 106.61.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.