For the 24 hours to 23:00 GMT, the GBP declined 0.37% against the USD and closed at 1.3083, as uncertainties surrounding Brexit resurfaced following discussions over fresh Brexit deadline.

In economic news, UK’s consumer price index rose 1.5% on an annual basis in November, more than market anticipations for an increase of 1.4% and compared to a similar rise in the previous month. Moreover, the nation’s retail price index rose 0.2% on a monthly basis in November, compared to a drop of 0.2% in the previous month. Meanwhile, the house price index climbed 0.7% on a yearly basis in October, rising at its weakest pace since September 2012 and less than market expectations for an increase of 1.6%. In the prior month, the index had recoded a rise of 1.3%.

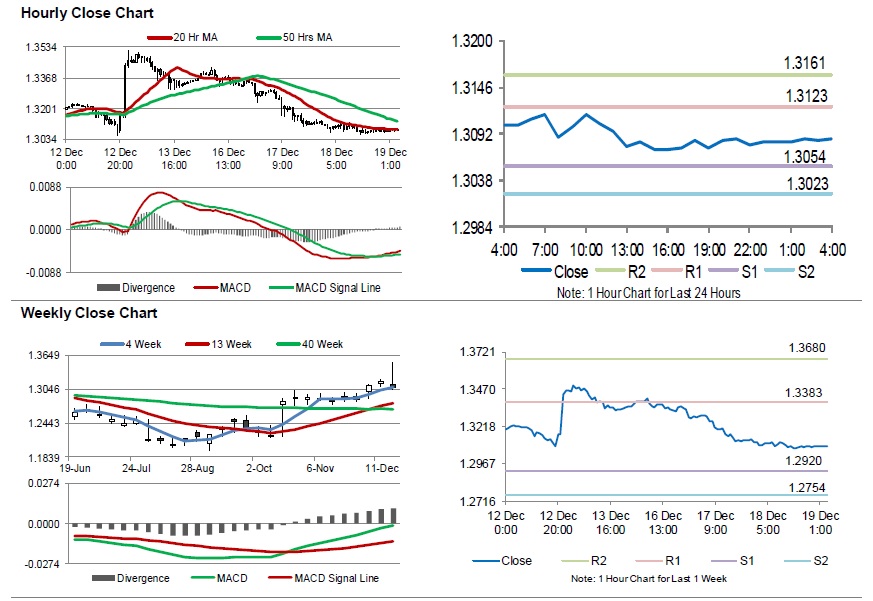

In the Asian session, at GMT0400, the pair is trading at 1.3086, with the GBP trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3054, and a fall through could take it to the next support level of 1.3023. The pair is expected to find its first resistance at 1.3123, and a rise through could take it to the next resistance level of 1.3161.

Trading trend in the sterling today, is expected to be determined by the Bank of England’s interest rate decision and meeting minutes followed by UK’s retail sales for November, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.