For the 24 hours to 23:00 GMT, the USD rose 0.06% against the JPY and closed at 109.57.

In the Asian session, at GMT0400, the pair is trading at 109.57, with the USD trading flat against the JPY from yesterday’s close.

The Bank of Japan (BoJ), in its latest monetary policy meeting, decided to leave its benchmark interest rate at -0.1%, as widely expected and pledged to maintain the yield target for 10-year Japanese government bonds around 0%. Further, the central bank continued to maintain its positive outlook on the economy and signalled that the policymakers are in no rush for a near-term move in monetary policy, despite persistent global risks to the economic growth. In a statement post meeting, Japan’s Prime Minister’s Adviser, Shinzo Abe criticised BoJ’s negative rate policy and stated that the central bank needs to take stronger fiscal measures in order to support the weak economy.

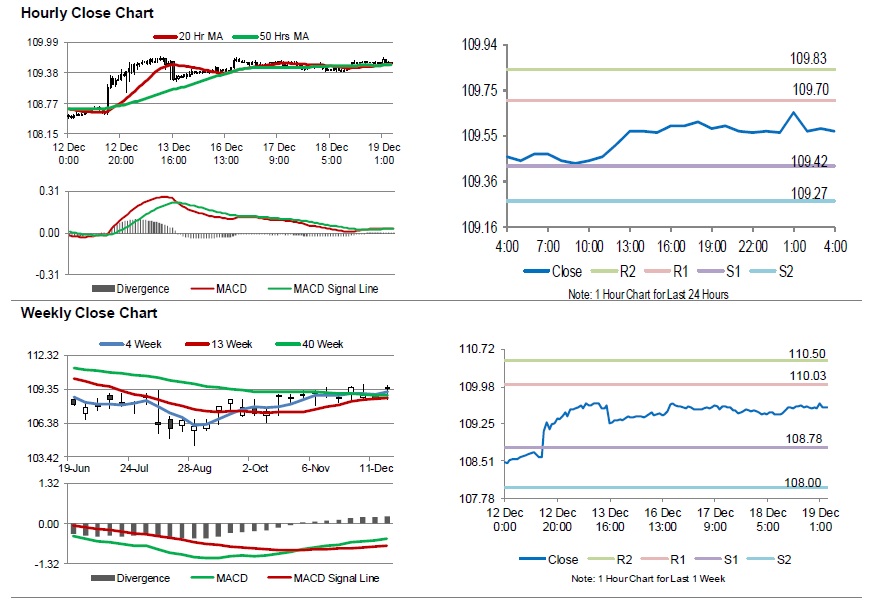

The pair is expected to find support at 109.42, and a fall through could take it to the next support level of 109.27. The pair is expected to find its first resistance at 109.70, and a rise through could take it to the next resistance level of 109.83.

Going forward, traders would closely monitor Japan’s national consumer price index for November, set to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.