For the 24 hours to 23:00 GMT, the GBP declined 0.11% against the USD and closed at 1.2897.

On Friday, data indicated that UK’s flash gross domestic product (GDP) climbed 0.3% QoQ in the first three months of 2017, expanding at its slowest pace in twelve months, as a spike in inflation continued to weigh on household incomes. The nation’s GDP advanced 0.7% in the previous quarter, whereas markets anticipated for an advance of 0.4%. Meanwhile, the nation’s BBA mortgage approvals fell to a level of 41.1K in March, compared to a revised level of 42.3K in the previous month.

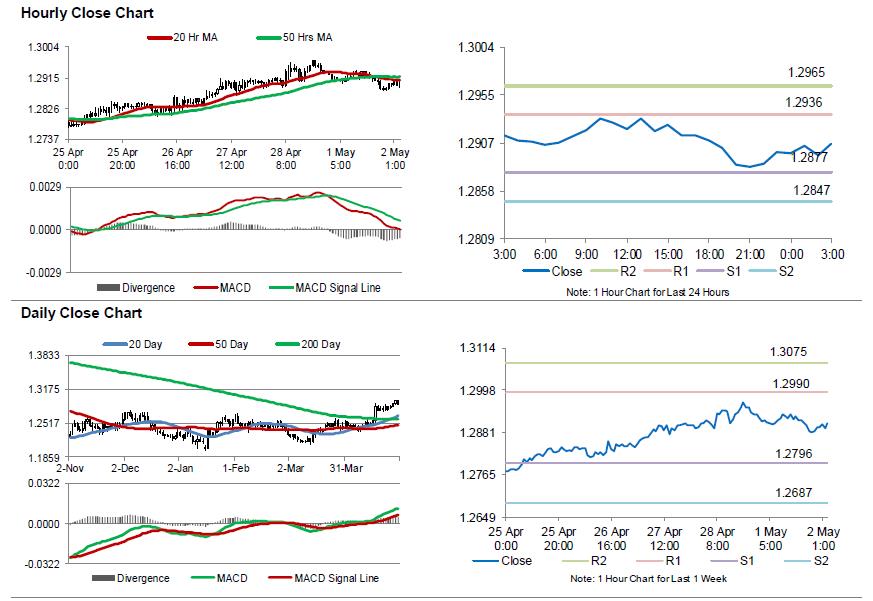

In the Asian session, at GMT0300, the pair is trading at 1.2906, with the GBP trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2877, and a fall through could take it to the next support level of 1.2847. The pair is expected to find its first resistance at 1.2936, and a rise through could take it to the next resistance level of 1.2965.

Trading trends in the pair today is expected to be determined by the release of Britain’s Markit manufacturing PMI for April, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.