For the 24 hours to 23:00 GMT, the USD rose 0.15% against the JPY and closed at 111.85.

In the Asian session, at GMT0300, the pair is trading at 111.84, with the USD trading slightly lower against the JPY from yesterday’s close.

Earlier today, minutes of the Bank of Japan’s (BoJ) March monetary policy meeting showed that policymakers agreed to keep a close watch on consumer prices. Further, they indicated that tighter labour conditions and rebounding energy prices are having a short-term effect on consumer prices.

On the data front, Japan’s Nikkei services PMI fell to a level of 52.2 in April, compared to a reading of 52.9 in the prior month.

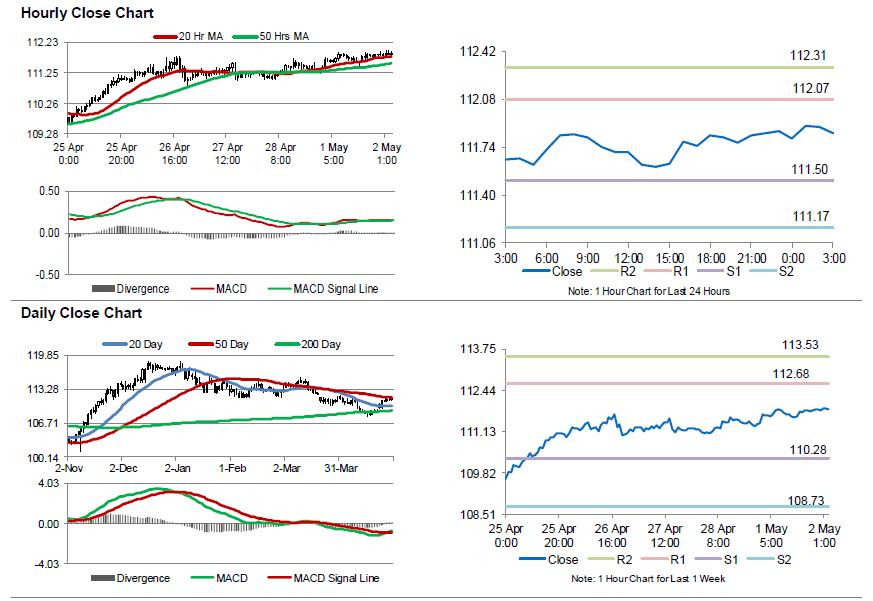

The pair is expected to find support at 111.50, and a fall through could take it to the next support level of 111.17. The pair is expected to find its first resistance at 112.07, and a rise through could take it to the next resistance level of 112.31.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.