For the 24 hours to 23:00 GMT, USD rose 0.28% against the CAD to close at 0.9787.

Loonie declined against the US dollar after the release of disappointing economic data from Canada and lingering European debt fears.

In Canada, the Industrial Product Price Index declined 0.3% (M-o-M) in July, following a 0.2% decline in the previous month. Additionally, in the second quarter of 2011, the current account deficit widened to reach C$15.3 billion, from C$10.07 billion in the previous quarter.

In the Asian session at 3:00GMT, the Canadian Dollar is trading at 0.9789, flat against the greenback from yesterday’s close at 23:00 GMT.

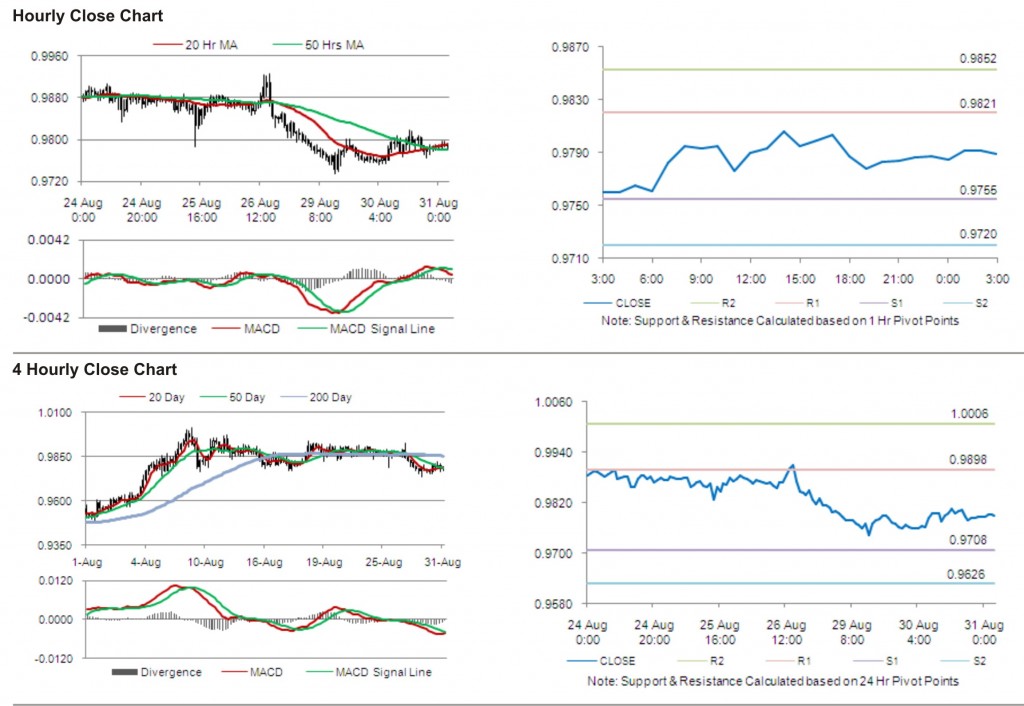

The first area of short term resistance is observed at 0.9821, followed by 0.9852 and 0.9918. The first area of support is at 0.9755, with the subsequent supports at 0.9720 and 0.9654.

Trading trends in the pair today are expected to be determined by release of Gross Domestic Product (GDP) data in Canada.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.