For the 24 hours to 23:00 GMT, AUD strengthened 0.34% against the USD to close at 1.0650, on the back of recent strength in equity markets, as investor sentiment rebounds.

In the economic news, in the US, the conference board reported that its consumer confidence index plunged to 44.5 in August, the lowest level since April 2009, and compared to a downwardly revised reading of 59.2 posted in July. The S&P/Case-Shiller index of property values in 20 cities declined 4.5% (Y-o-Y) in June, following a 4.6% drop recorded in May. On a seasonally adjusted monthly basis, the home prices fell 0.1% in June, following a 0.1% drop recorded in May.

In the morning economic news, the private sector credit in Australia rose 0.2% (M-o-M) in July following a 0.1% decline in the previous month.

In the Asian session at 3:00GMT, the Australian Dollar is trading at 1.0674, 0.23% higher from yesterday’s close at 23:00 GMT.

LME Copper prices rose 0.4% or $36.8/MT to $9,127.0/ MT. Aluminium prices rose 1.4% or $31.8/MT to $2,360.5/ MT.

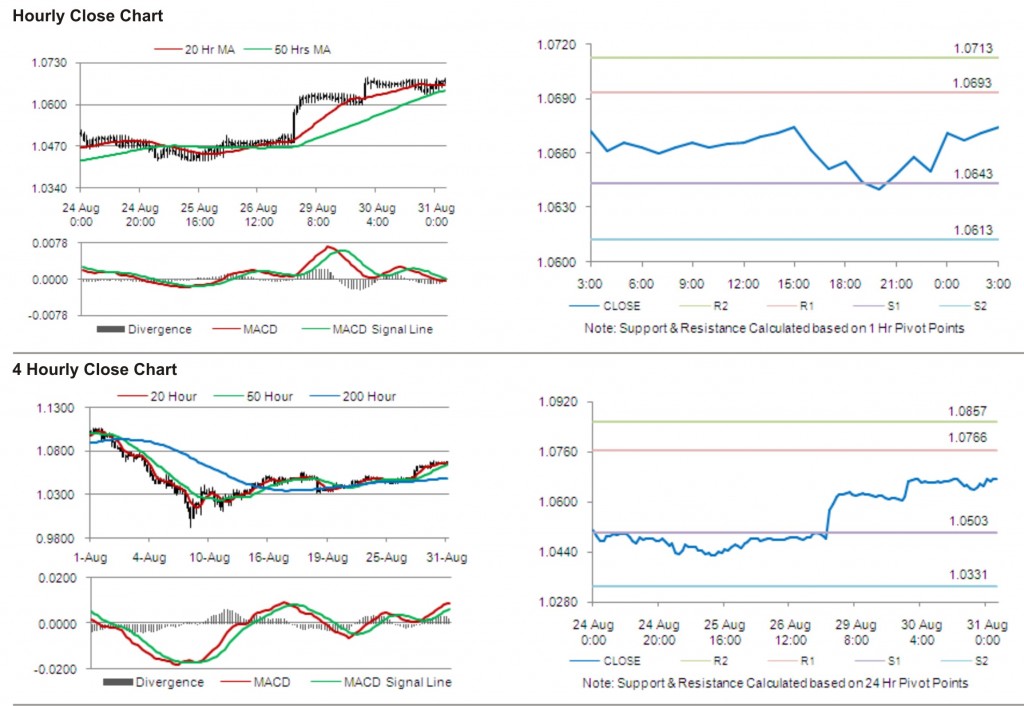

The pair is expected to find first short term resistance at 1.0693, with the next resistance levels at 1.0713 and 1.0763, subsequently. The first support for the pair is seen at 1.0643, followed by next supports at 1.0613 and 1.0563 respectively.

With a series of Australia economic releases today, including AiG Performance of Manufacturing Index and retail sales, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.