For the 24 hours to 23:00 GMT, the USD declined 0.15% against the CAD to close at 1.0714.

On the macro front, the Teranet and National Bank of Canada reported that housing price index in Canada on a yearly basis rose 4.4% in June, compared to a 4.6% increase in the previous month.

Yesterday, ratings agency, Fitch Ratings cautioned that the house prices in Canada were overvalued by almost 20% and the government should take appropriate measures to cool the overheated housing market.

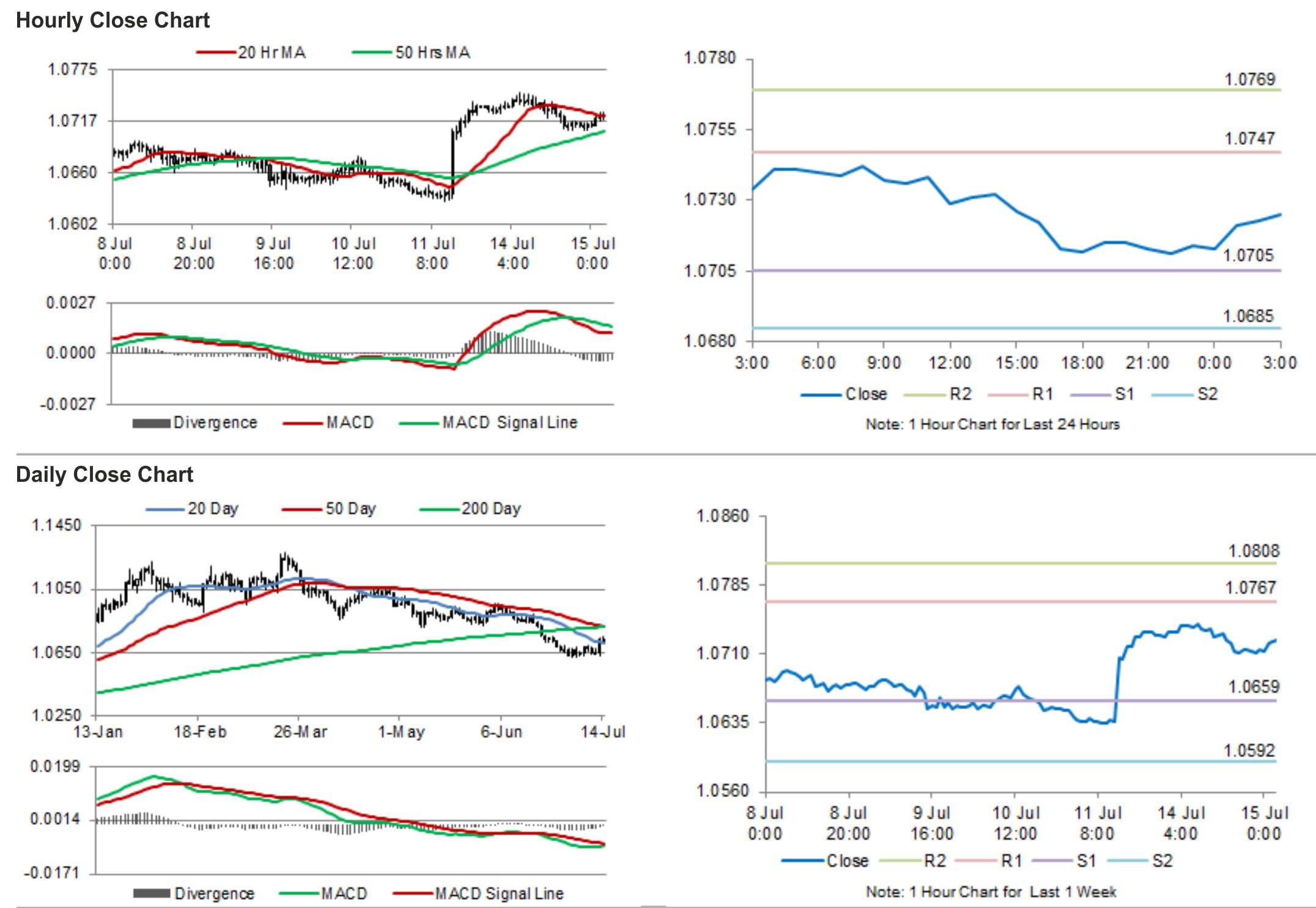

In the Asian session, at GMT0300, the pair is trading at 1.0725, with the USD trading 0.10% higher from yesterday’s close.

The pair is expected to find support at 1.0705, and a fall through could take it to the next support level of 1.0685. The pair is expected to find its first resistance at 1.0747, and a rise through could take it to the next resistance level of 1.0769.

With no major economic releases in Canada, traders would look forward to global economic news for cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.