For the 24 hours to 23:00 GMT, the USD rose 0.41% against the CAD to close at 1.1524.

Yesterday, data showed that Canada’s new housing price index rose 1.6% on an annual basis in October, compared to a similar rise registered in September.

Separately, the BoC Governor, Stephen Poloz dispelled concerns over the possibility of a housing bubble in the Canadian economy by mentioning that the central bank does not foresee a rise in the nation’s unemployment rate or mortgage rates, which are two significant factors that could trigger a crash in the country’s housing market.

In the Asian session, at GMT0400, the pair is trading at 1.1548, with the USD trading 0.21% higher from yesterday’s close.

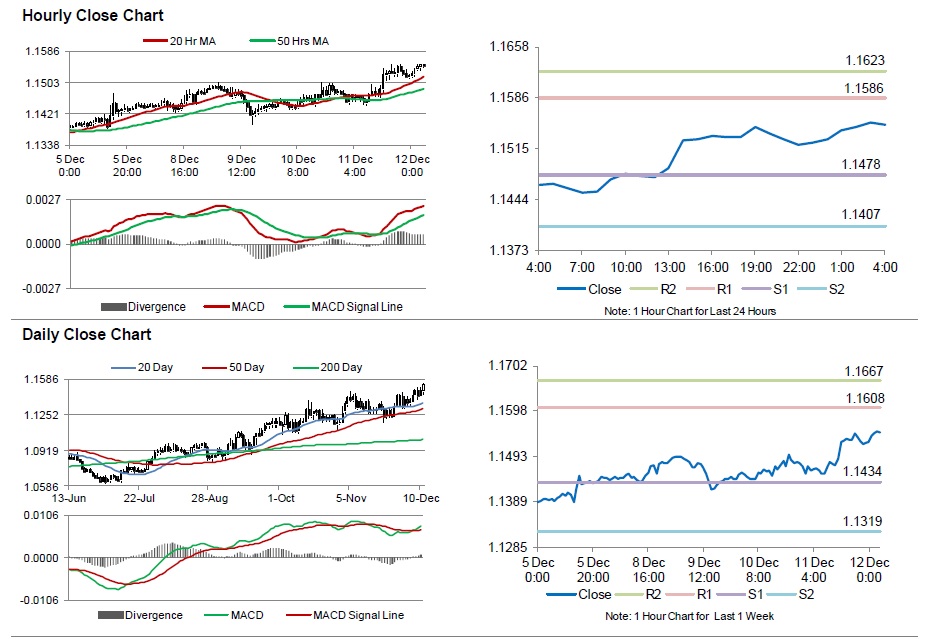

The pair is expected to find support at 1.1478, and a fall through could take it to the next support level of 1.1407. The pair is expected to find its first resistance at 1.1586, and a rise through could take it to the next resistance level of 1.1623.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.