For the 24 hours to 23:00 GMT, the USD rose 0.17% against the CHF and closed at 0.9684, following upbeat economic data from the US.

Yesterday, the SNB maintained its key interest rate at 0.0% for the 14th consecutive quarter, at par with market expectations. Additionally, the SNB’s President, Thomas Jordan in a statement post the interest rate decision reiterated the central bank’s commitment to keep the minimum exchange rate of CHF 1.20 per Euro. He further added that the nation’s economy would likely slow down in the fourth-quarter of 2014, as sluggish Euro-area growth was weighing on Swiss exports.

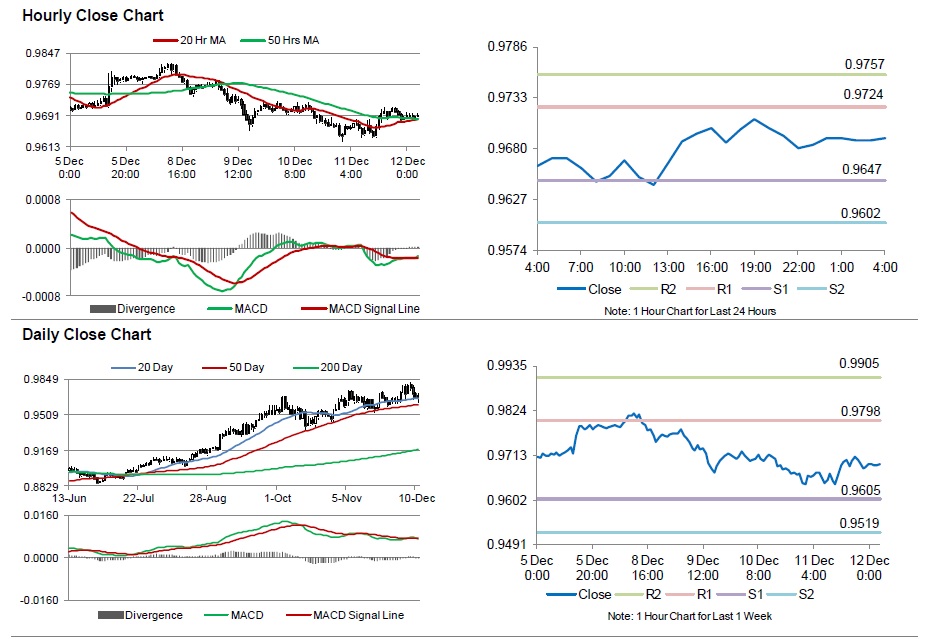

In the Asian session, at GMT0400, the pair is trading at 0.9691, with the USD trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 0.9647, and a fall through could take it to the next support level of 0.9602. The pair is expected to find its first resistance at 0.9724, and a rise through could take it to the next resistance level of 0.9757.

Amid no economic releases in Switzerland today, investors await the Swiss ZEW economic expectation survey data, scheduled next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.