On Friday, the USD declined 0.11% against the CAD to close at 1.2092, after the US non-farm payrolls increased less than expected in April.

In economic news, Canada’s unemployment rate remained unchanged at 6.8% in April, lower than market expectations of an advance to 6.9%. On the other hand, participation rate unexpectedly fell to a level of 65.8% in April, compared to market expectations of an unchanged reading of 65.9% registered in the preceding month.

Other economic data showed that the seasonally adjusted housing starts for Canada eased to 181.80 K in April, lower than market expectations of a drop to 182.00 K. In the prior month, it had registered a revised level of 189.50 K.

In the Asian session, at GMT0300, the pair is trading at 1.2116, with the USD trading 0.2% higher from Friday’s close.

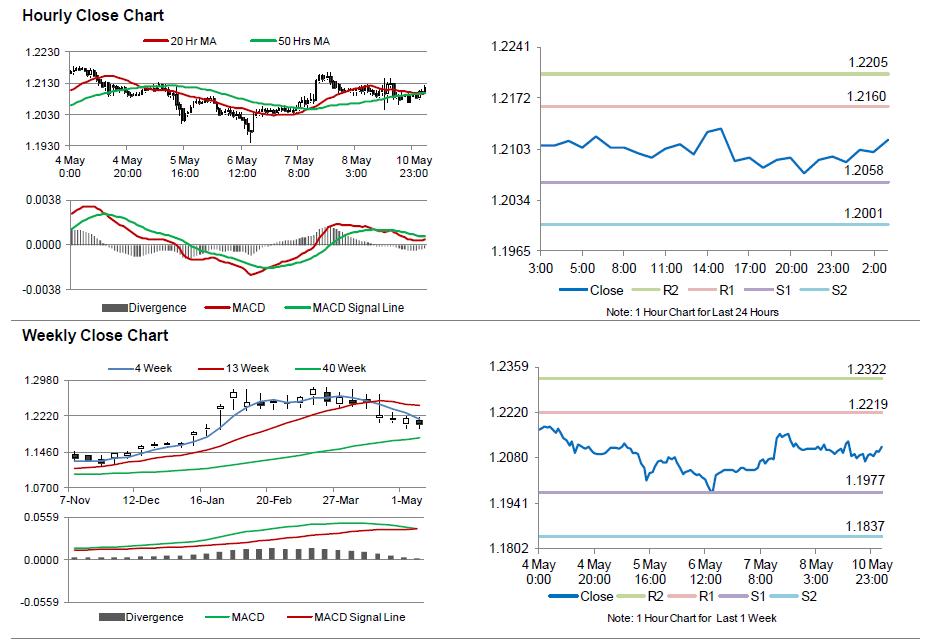

The pair is expected to find support at 1.2058, and a fall through could take it to the next support level of 1.2001. The pair is expected to find its first resistance at 1.2160, and a rise through could take it to the next resistance level of 1.2205.

With no economic releases in Canada today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.