On Friday, the USD rose 0.95% against the CHF and closed at 0.9312. The Swiss Franc lost ground, after Switzerland’s CPI surprisingly slid 0.2% on a monthly basis in April, compared to a 0.1% rise and following an advance of 0.3% registered in the prior month.

Other economic data indicated that the seasonally adjusted unemployment rate in Switzerland edged up to 3.3% in April, compared to previous month’s level of 3.2%.

Separately, the SNB Chairman, Thomas Jordan mentioned that the Franc was still having elevated value and warned that the central bank stood ready to intervene in the foreign exchange market, if necessary.

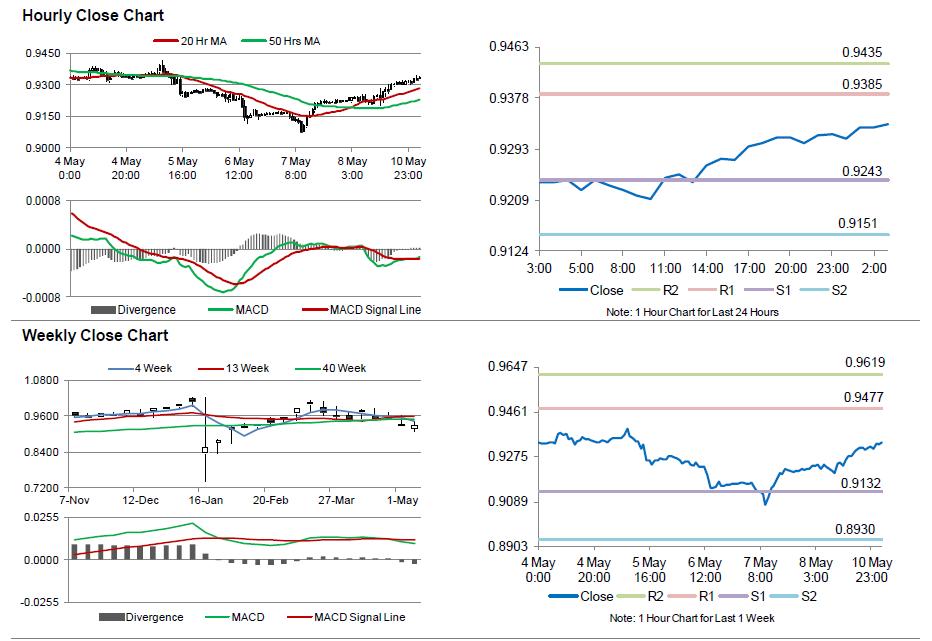

In the Asian session, at GMT0300, the pair is trading at 0.9335, with the USD trading 0.24% higher from Friday’s close.

The pair is expected to find support at 0.9243, and a fall through could take it to the next support level of 0.9151. The pair is expected to find its first resistance at 0.9385, and a rise through could take it to the next resistance level of 0.9435.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.