For the 24 hours to 23:00 GMT, the USD rose marginally against the CAD to close at 1.1053.

Earlier during the day, the Canadian Dollar advanced after data showed that the Canada’s GDP rose 0.5% (MoM) in January, more than economists’ estimates for a 0.4% rise and compared to a 0.5% drop registered in the previous month. However, the Loonie came under pressure after Moody’s Investors Service, in a report, opined that a weakness in the Canadian Dollar could prove beneficial to the companies in the nation.

In the Asian session, at GMT0300, the pair is trading at 1.1050, with the USD trading marginally lower from yesterday’s close.

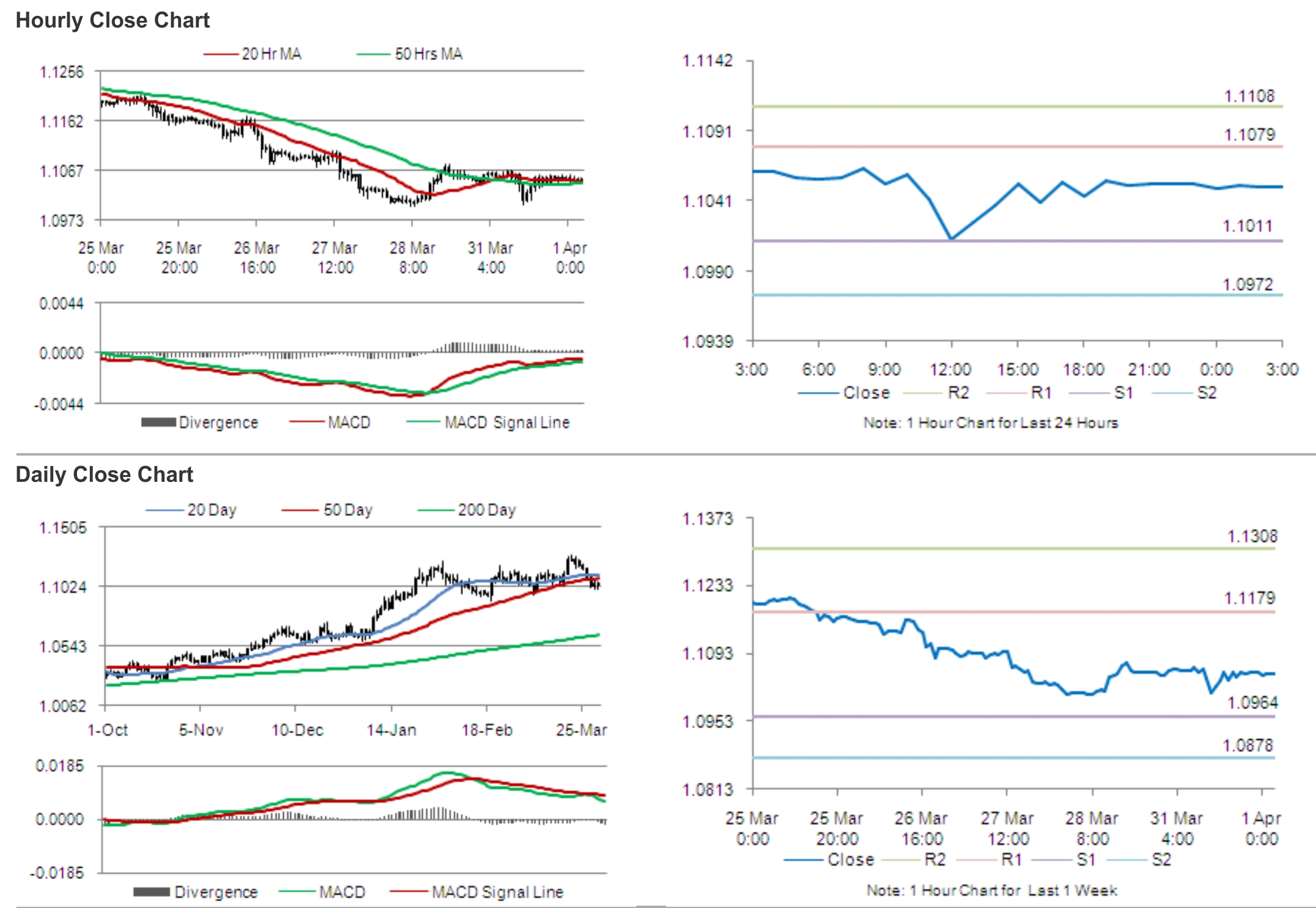

The pair is expected to find support at 1.1011, and a fall through could take it to the next support level of 1.0972. The pair is expected to find its first resistance at 1.1079, and a rise through could take it to the next resistance level of 1.1108.

Later today, the Statistics Canada is scheduled to publish data on Canada’s industrial product price and raw material price index.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.