For the 24 hours to 23:00 GMT, the USD declined 0.29% against the CHF and closed at 0.8845.

Yesterday, in an interview with the Wall Street Journal, the SNB Chief, Thomas Jordan, stated that the minimum exchange rate “remains the right monetary policy for Switzerland for the foreseeable future.” He further stated that the central bank continues to face the same problem it faced two years ago when the SNB chief took charge that of a strong currency that has pressurised the central bank to hold interest rates near zero for the longest period in more than five decades.

In economic news, the Swiss KOF leading indicator edged down to a reading of 1.99 in March, contradicting analysts’ expectations for the indicator to come in unchanged at previous month’s level of 2.03.

In the Asian session, at GMT0300, the pair is trading at 0.8848, with the USD trading marginally higher from yesterday’s close.

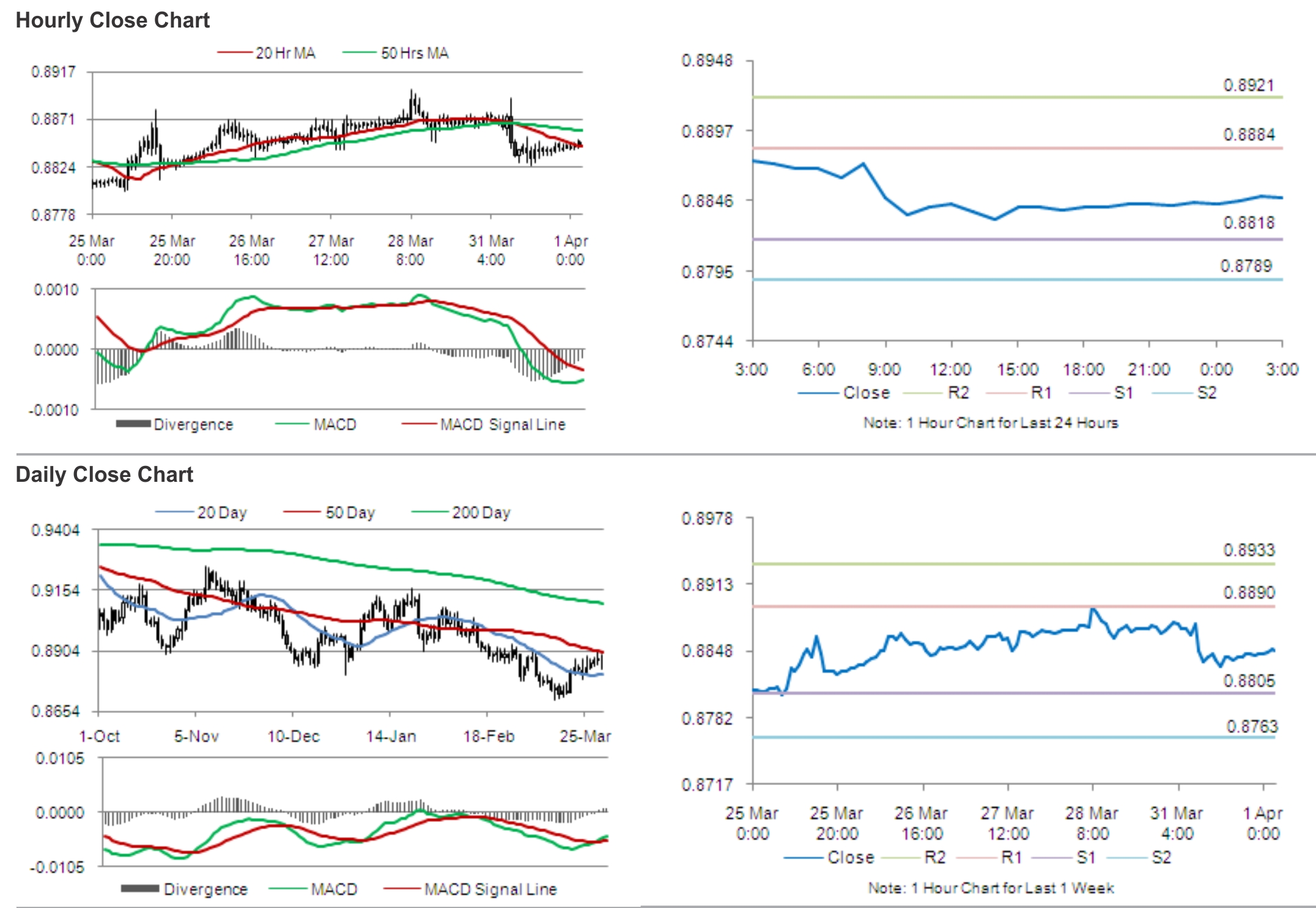

The pair is expected to find support at 0.8818, and a fall through could take it to the next support level of 0.8789. The pair is expected to find its first resistance at 0.8884, and a rise through could take it to the next resistance level of 0.8921.

Traders are expected to keep a tab on the SVME – purchasing managers’ index data, due for release later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.