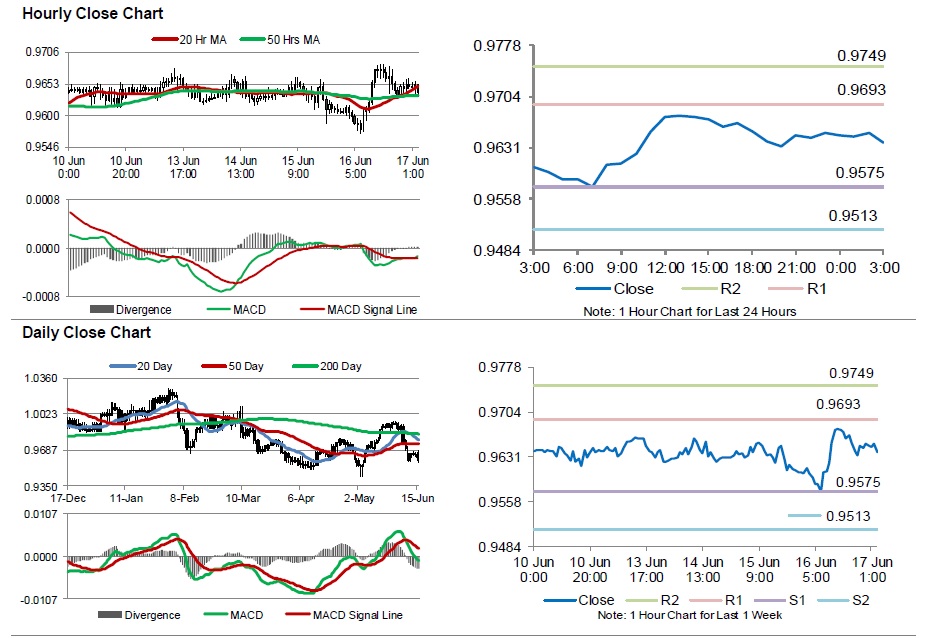

For the 24 hours to 23:00 GMT, the USD rose 0.49% against the CHF and closed at 0.9653.

Yesterday, the Swiss National Bank (SNB) held the benchmark interest rate steady at -0.75%, as widely expected. The SNB Chairman, Thomas Jordan, reiterated that the central bank is prepared to take further action to weaken the Swiss Franc, as it still remains significantly overvalued. Further, the SNB upgraded its consumer price forecast for this year, and now expects a decline of 0.4% compared to earlier expectation of a 0.8% drop. Also, it expects 0.3% inflation in 2017 and 0.9% in 2018.

Additionally, the SNB, in its 2016 Financial Stability Report, indicated that a prolonged period of low rates poses a risk to global financial stability.

In the Asian session, at GMT0300, the pair is trading at 0.9638, with the USD trading 0.16% lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9575, and a fall through could take it to the next support level of 0.9513. The pair is expected to find its first resistance at 0.9693, and a rise through could take it to the next resistance level of 0.9749.

With no economic releases in Switzerland today, investors will look forward to the nation’s trade balance, ZEW expectations survey data and the SNB’s Q2 Bulletin, due next week.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.