For the 24 hours to 23:00 GMT, the USD weakened 1.43% against the JPY and closed at 104.34.

Yesterday, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, expressed confidence in the central bank’s monetary stimulus policy and indicated that the Japanese economy is likely to expand moderately as a trend. He further stated that the BoJ’s inflation target of 2.0% would be achieved by March 2018.

In the Asian session, at GMT0300, the pair is trading at 104.49, with the USD trading 0.14% higher against the JPY from yesterday’s close.

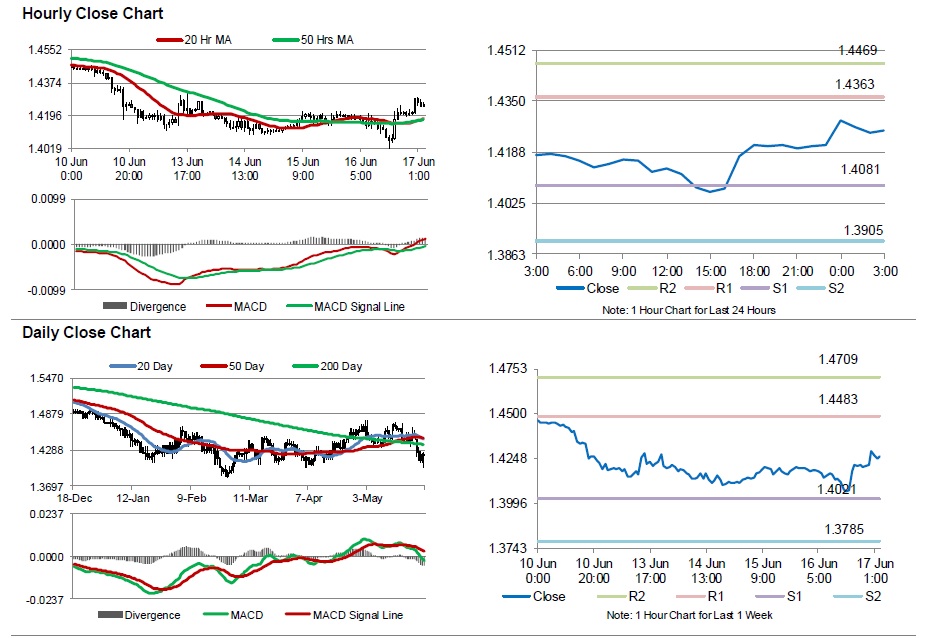

The pair is expected to find support at 103.50, and a fall through could take it to the next support level of 102.50. The pair is expected to find its first resistance at 105.57, and a rise through could take it to the next resistance level of 106.64.

With no economic releases in Japan today, market participants will look forward to the nation’s adjusted merchandise trade balance, all industry activity index and the Nikkei manufacturing PMI data along with the BoJ’s monetary policy meeting minutes, all scheduled to release in the next week.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.