For the 24 hours to 23:00 GMT, the USD declined 0.89% against the CHF and closed at 0.9589.

Yesterday, the Swiss National Bank (SNB) left its benchmark interest rates unchanged at -0.75%, in line with market expectations and lowered its inflation outlook to 0.8% from 0.9% for 2019. However, inflation forecast for 2018 was maintained at 0.9%. Meanwhile, the central bank forecasted a GDP growth of between 2.5% and 3.0% for the current year and a further slight fall in unemployment. Moreover, the policymakers suggested that the current economic outlook remains favourable but expects a slowdown in the momentum due to global trade issues and recent fall in the national currency.

Macroeconomic data indicated that Switzerland’s trade surplus narrowed CHF2.13 million in August, defying market consensus to expand to a level of CHF2.41 million. In the previous month, the nation had posted a revised reading of CHF2.21 million.

In the Asian session, at GMT0300, the pair is trading at 0.9585, with the USD trading a tad lower against the CHF from yesterday’s close.

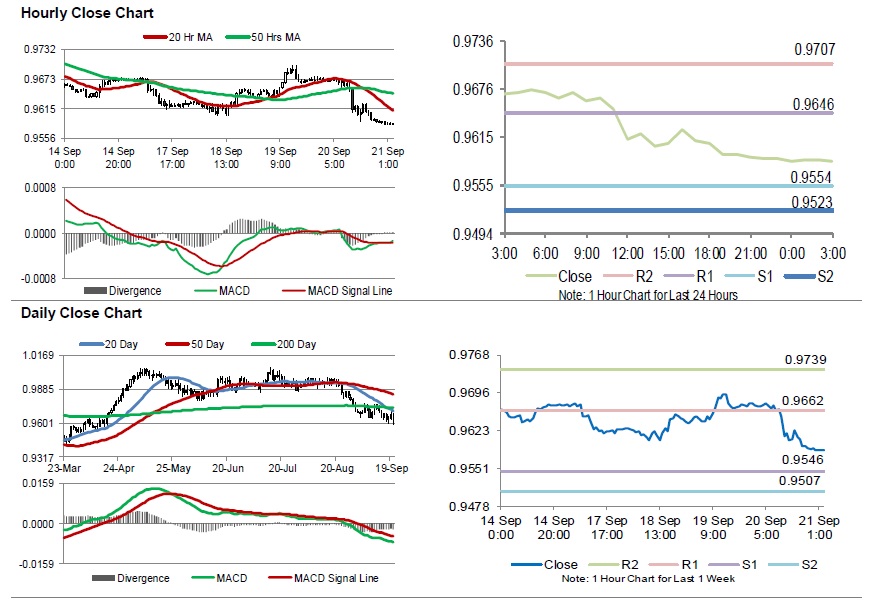

The pair is expected to find support at 0.9554, and a fall through could take it to the next support level of 0.9523. The pair is expected to find its first resistance at 0.9646, and a rise through could take it to the next resistance level of 0.9707.

Moving ahead, traders would await Switzerland’s M3 money supply for August, set to release in a while.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.