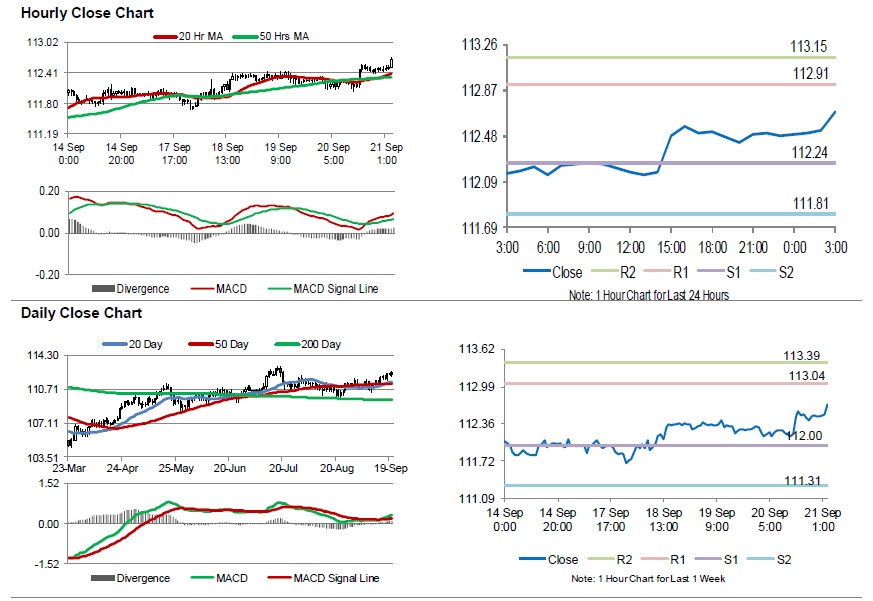

For the 24 hours to 23:00 GMT, the USD rose 0.18% against the JPY and closed at 112.48.

On the macro front, Japan’s national consumer price index (CPI) increased 1.3% on an annual basis in August, compared to a rise of 0.9% in the prior month. Market participants had anticipated the CPI to rise to 1.1%. Moreover, the nation’s flash manufacturing PMI climbed to a 3-month high level of 52.9 in September. In the prior month, the PMI had recorded a reading of 52.5.

In the Asian session, at GMT0300, the pair is trading at 112.68, with the USD trading 0.18% higher against the JPY from yesterday’s close.

The pair is expected to find support at 112.24, and a fall through could take it to the next support level of 111.81. The pair is expected to find its first resistance at 112.91, and a rise through could take it to the next resistance level of 113.15.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.