For the 24 hours to 23:00 GMT, the USD rose 0.34% against the CHF and closed at 0.9896.

Yesterday, the Swiss National Bank (SNB) retained the benchmark interest rate at -0.75% and projected that inflation in Switzerland would exceed its target in three years. However, the central bank reiterated its commitment to “intervene in the foreign exchange market as necessary”. The central bank upgraded its inflation forecast to 0.5% for 2017, up from 0.4% predicted earlier and to 0.7% for next year, from 0.4%. The central bank also predicted the Swiss economy to expand around 2.0% in 2018, after advancing by 1.0% in 2017.

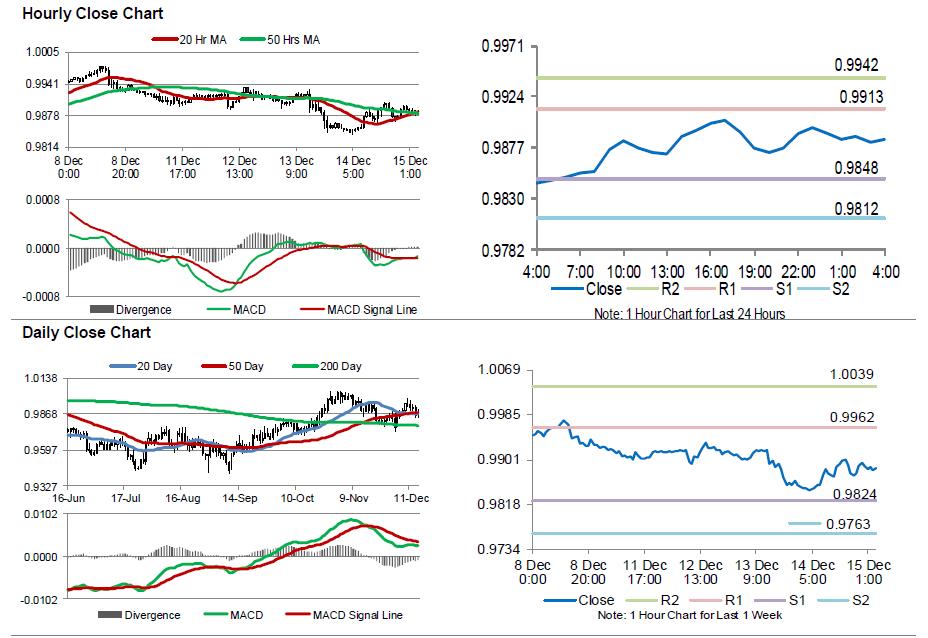

In the Asian session, at GMT0400, the pair is trading at 0.9885, with the USD trading 0.11% lower against the CHF from yesterday’s close.

The pair is expected to find support at 0.9848, and a fall through could take it to the next support level of 0.9812. The pair is expected to find its first resistance at 0.9913, and a rise through could take it to the next resistance level of 0.9942.

Moving ahead, market participants would eye Switzerland’s trade balance and the KOF leading indicator, both due to release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.