For the 24 hours to 23:00 GMT, the USD declined 0.28% against the JPY and closed at 112.38.

In the Asian session, at GMT0400, the pair is trading at 112.27, with the USD trading 0.1% lower against the JPY from yesterday’s close.

Overnight data revealed that Japan’s Tankan large manufacturing index rose more-than-expected to a level of 25.0 in 4Q 2017, surging to an 11-year high level. Market participants had anticipated for a rise to a level of 24.0, compared to a reading of 22.0 in the preceding month. Meanwhile, the nation’s Tankan non-manufacturing index remained steady at a level of 23.0 in 4Q 2017, while investors had envisaged for an increase to a level of 24.0.

Moreover, the nation’s Tankan large manufacturing outlook index unexpectedly remained steady at 19.0 in 4Q 2017, while the non-manufacturing outlook index climbed less-than-anticipated to a level of 20.0 in 4Q 2017, after recording a reading of 19.0 in the previous month.

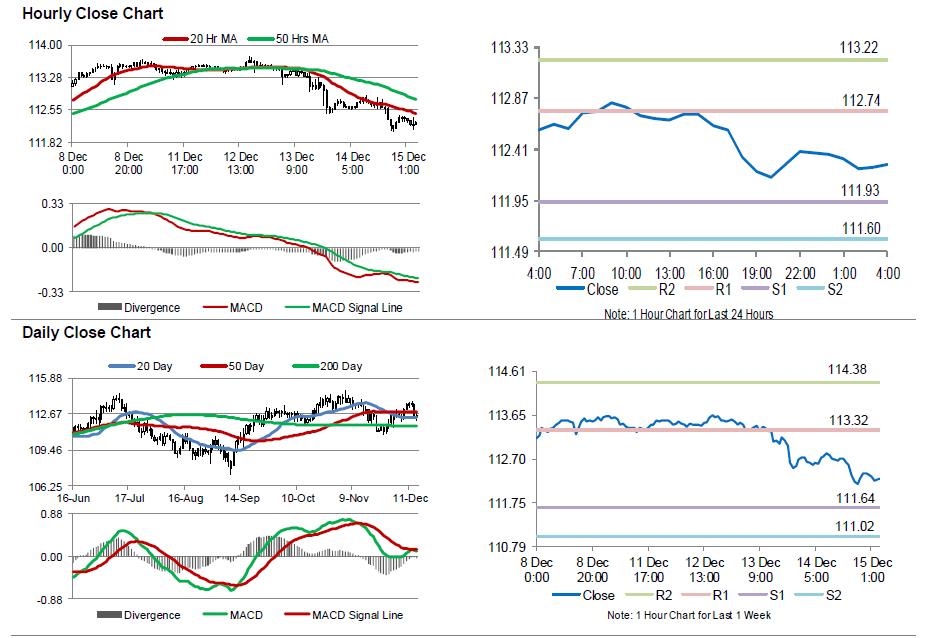

The pair is expected to find support at 111.93, and a fall through could take it to the next support level of 111.60. The pair is expected to find its first resistance at 112.74, and a rise through could take it to the next resistance level of 113.22.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.