For the 24 hours to 23:00 GMT, USD rose 1.18% against the CHF, on Friday, and closed at 0.8841, as Switzerland’s Economy Minister, Johann Schneider-Ammann, stated that the currency remains “massively overvalued” even after the nation’s central bank imposed a ceiling.

In the US, the wholesale inventories rose 0.8% (M-o-M) in July, following a 0.6% rise recorded in June.

This morning, Moody’s Investors Service stated that the Swiss National Bank’s cap on the strength of the Swiss franc is credit positive for both the sovereign and the country’s banks.

In the Asian session, at 3:00GMT, the USD is trading at 0.8872, 0.35% higher versus Swiss Franc, from Friday’s close at 23:00 GMT.

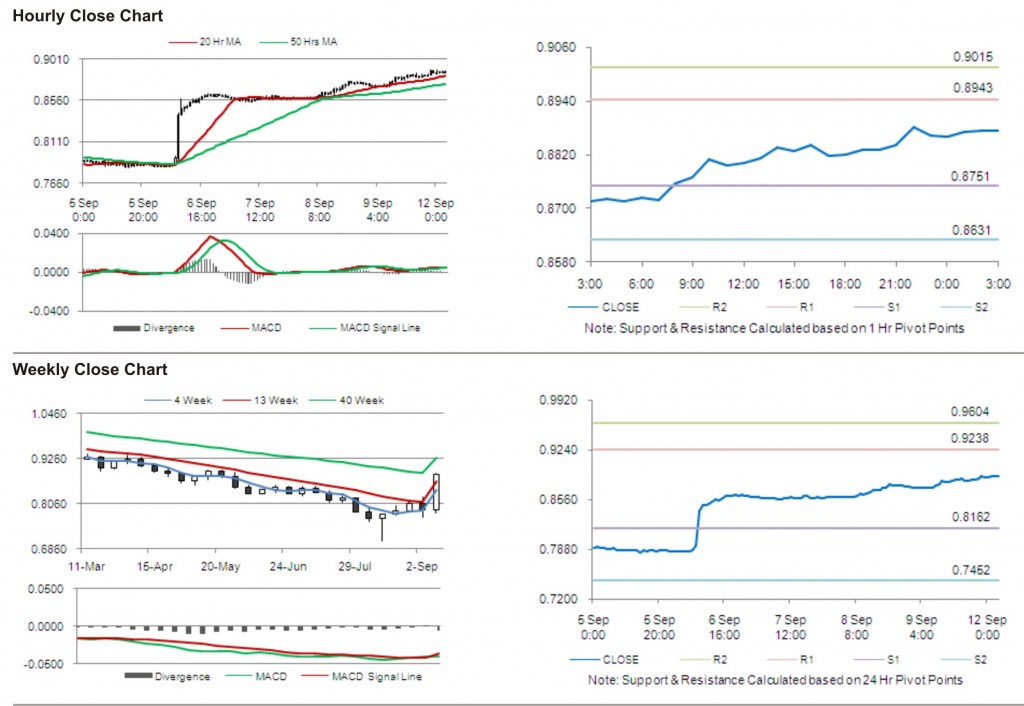

The pair has its first short term resistance at 0.8943, followed by the next resistance at 0.9015. The first area of support is at 0.8751 level, with the subsequent support at 0.8631.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.