For the 24 hours to 23:00 GMT, USD strengthened 0.12% against the JPY, on Friday, and closed at 77.59.

In Japan, on Friday, the seasonally adjusted Consumer Sentiment Index remained unchanged at a reading of 37.0 in August.

Additionally, this morning, the Tertiary Industry Index declined 0.1% (M-o-M) in July following a 1.8% decline in the previous month. The Domestic Corporate Goods Price Index declined 0.2% (M-o-M) in August compared to 0.2% in the previous month.

The Bank of Japan monetary policy meeting minutes released this morning showed that the policy board members have agreed that the Central Bank should increase the size of asset purchases beyond the previous level to clearly demonstrate its easing stance. Additionally, Members of the Bank of Japan’s monetary policy board stated that the outlook for Japan’s economy continues to be murky as it recovers from the devastating earthquake and tsunami on March 11.

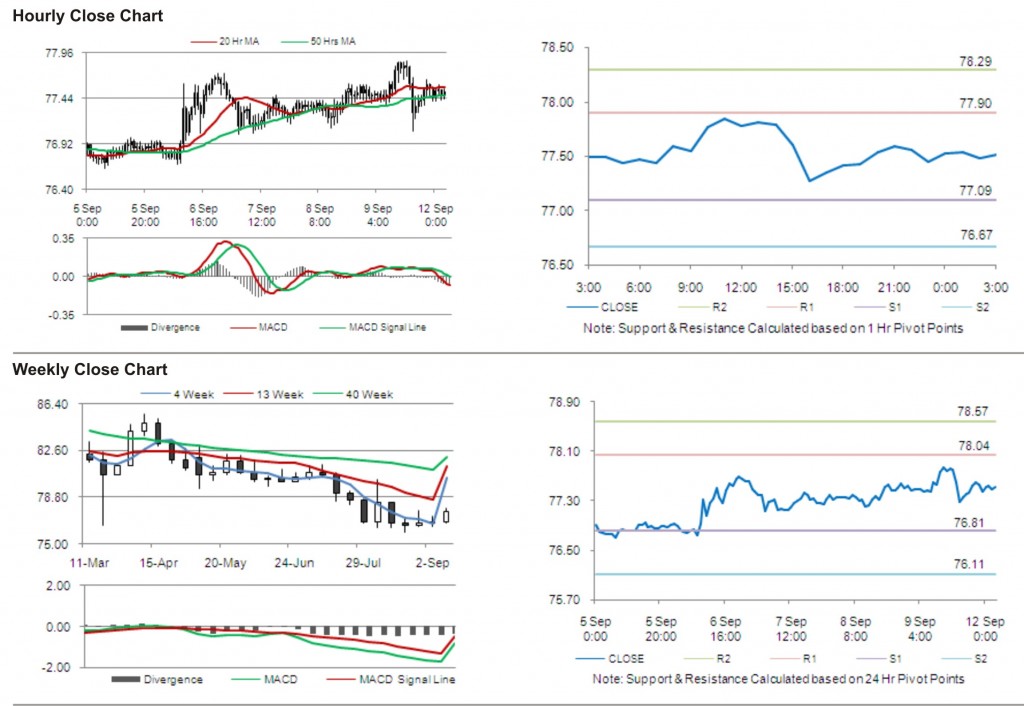

In the Asian session at 3:00GMT, the dollar is trading lower against yen from Friday’s close at 23:00 GMT, by 0.10%, at 77.51.

The first short term resistance is at 77.90, followed by 78.29. The pair is expected to find support at 77.09 and the subsequent support level at 76.67.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.