On Friday, the USD declined 0.14% against the CHF and closed at 0.9314. The Swiss Franc gained ground, after the Swiss industrial production grew at a faster rate, increasing 3.1%, on a quarterly basis, in 2Q 2014, following 0.6% rise in the previous quarter. Additionally, the foreign currency reserves surplus expanded in August to CHF453.8 billion, compared to CHF453.4 billion registered in the prior month.

In the Asian session, at GMT0300, the pair is trading at 0.9318, with the USD trading tad higher from Friday’s close.

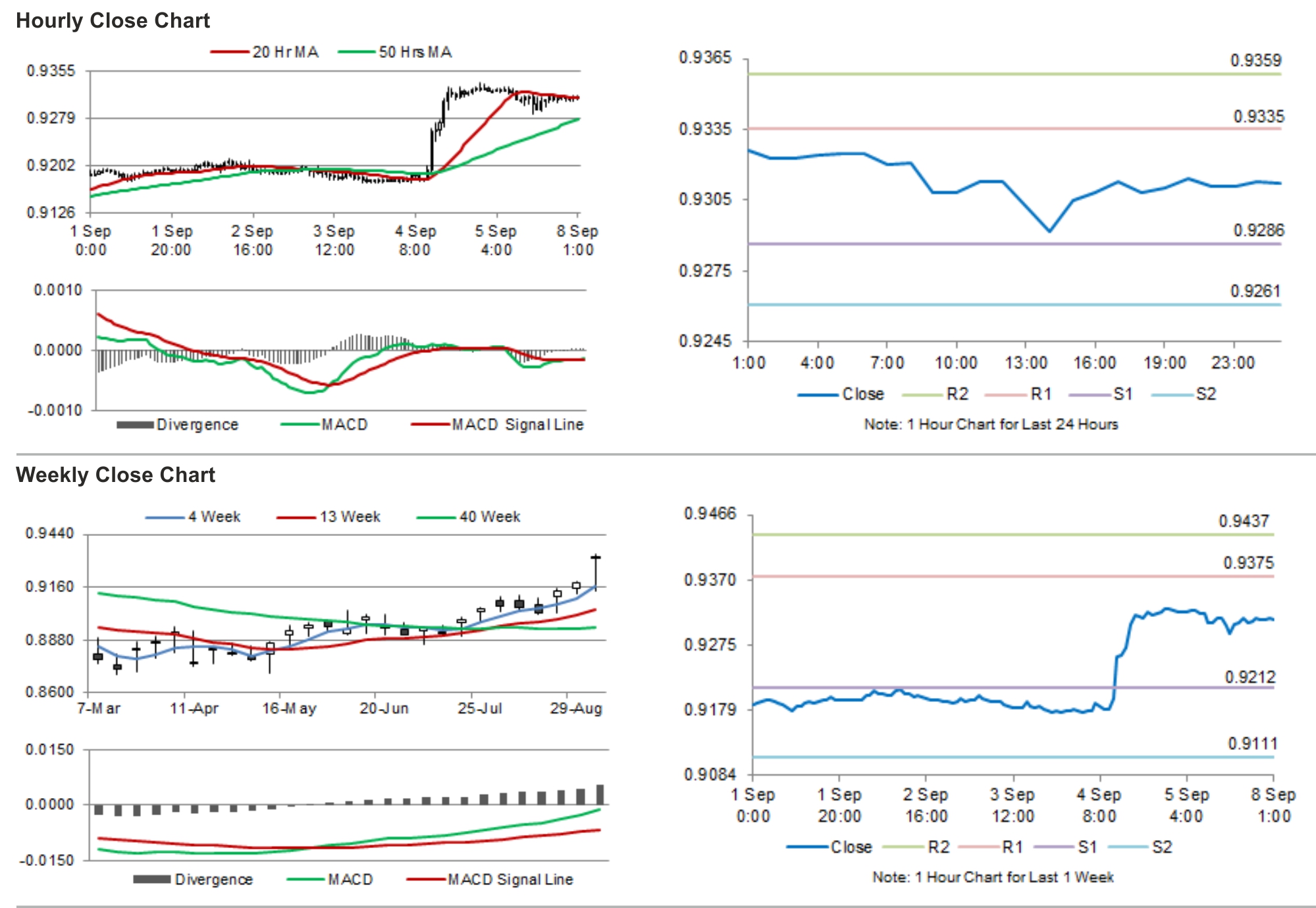

The pair is expected to find support at 0.9291, and a fall through could take it to the next support level of 0.9265. The pair is expected to find its first resistance at 0.9337, and a rise through could take it to the next resistance level of 0.9357.

Trading trends in the Swiss Franc today would be determined by Switzerland’s consumer prices and retail sales data as well as its unemployment rate, which are scheduled to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.