On Friday, the USD weakened 0.28% against the JPY and closed at 105.09. Japan’s leading economic index advanced to 106.5 in July, compared to a reading of 105.9 in the prior month, while the coincident index edged up to 109.9 in July, from previous month’s 109.7. Separately, the BoJ, in its monthly economic survey, reiterated that the economic growth in the nation is expected to remain moderate, on the back of improving conditions in Japan’s labour market.

In the Asian session, at GMT0300, the pair is trading at 105.06, with the USD trading marginally lower from yesterday’s close.

Early morning data indicated that, the final annualized GDP in Japan, shrank 7.1%, on a QoQ basis, in 2Q 2014, contracting more than market expectation of 7.0%, thus showing that the nation’s economy suffered a bigger setback following the sales-tax increase in April. The GDP had advanced 6.1% in the previous quarter. Additionally, Japan’s trade deficit (BOP basis) expanded to ¥828.1 billion in July, compared to a trade deficit of ¥537.1 billion in the previous month. Meanwhile, bank lending including trusts in the nation rose 2.2%, on a YoY basis, in August, following a similar rise registered in the previous month.

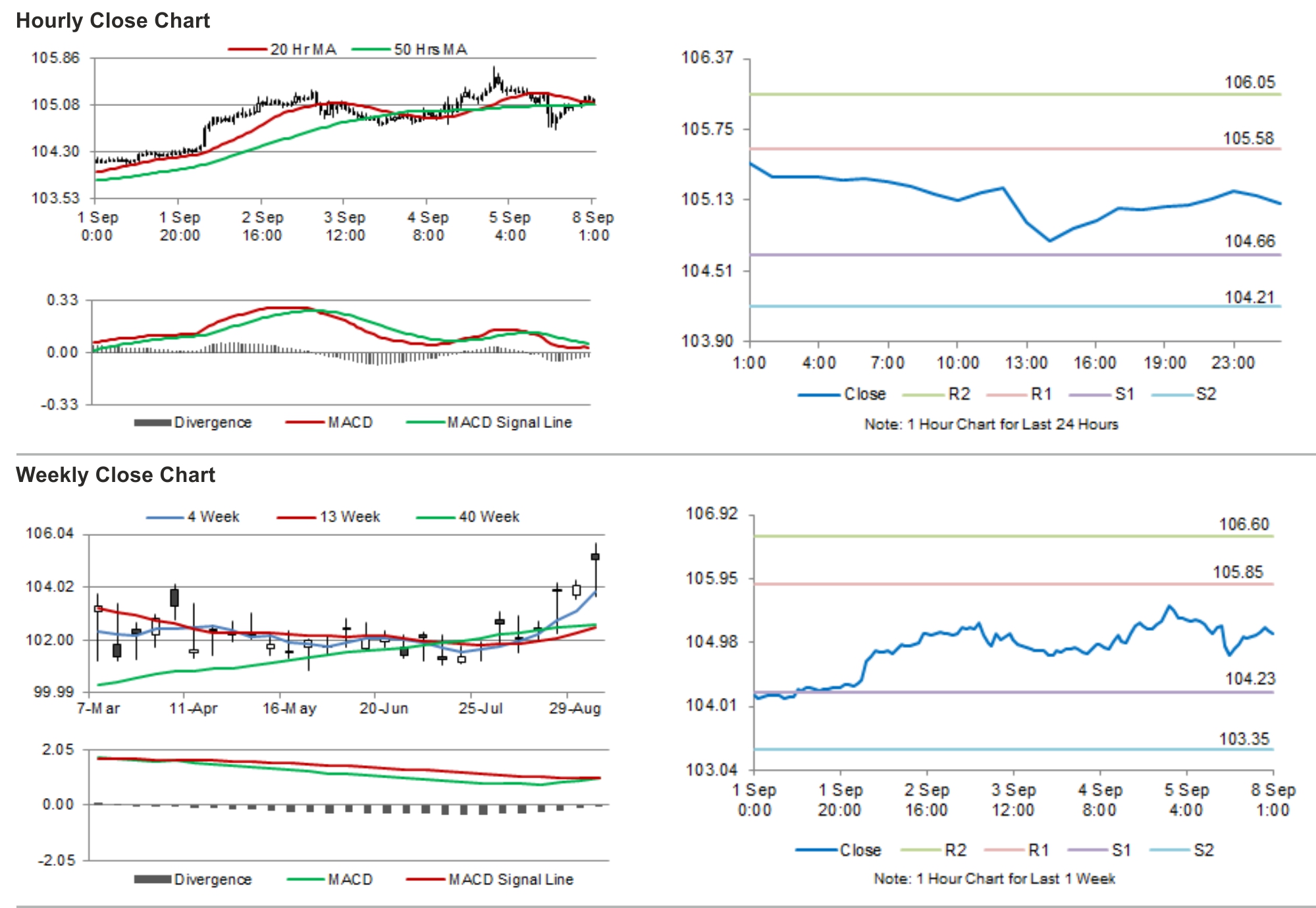

The pair is expected to find support at 104.69, and a fall through could take it to the next support level of 104.33. The pair is expected to find its first resistance at 105.41, and a rise through could take it to the next resistance level of 105.77.

Trading trends in the Yen today are expected to be determined by Eco Watchers’ Survey of the current situation as well as the future outlook of the Japanese economy, scheduled to release shortly.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.