For the 24 hours to 23:00 GMT, the USD rose 0.82% against the CHF and closed at 0.9728, after the US registered upbeat initial jobless claims data.

The Swiss Franc lost ground, after Switzerland’s SECO consumer confidence index weakened more than expected to -11.0 in October, higher than market expectations of a drop to -5.0. The index had eased to a level of -1.0 in the preceding month.

Yesterday, the SNB Chairman, Thomas Jordan indicated that the central bank would face a tough time if Swiss people voted in favour of the SNB increasing its gold holdings to 20%, as a referendum is set to take place on November 30 in Switzerland.

In the Asian session, at GMT0400, the pair is trading at 0.9728, with the USD trading flat from yesterday’s close.

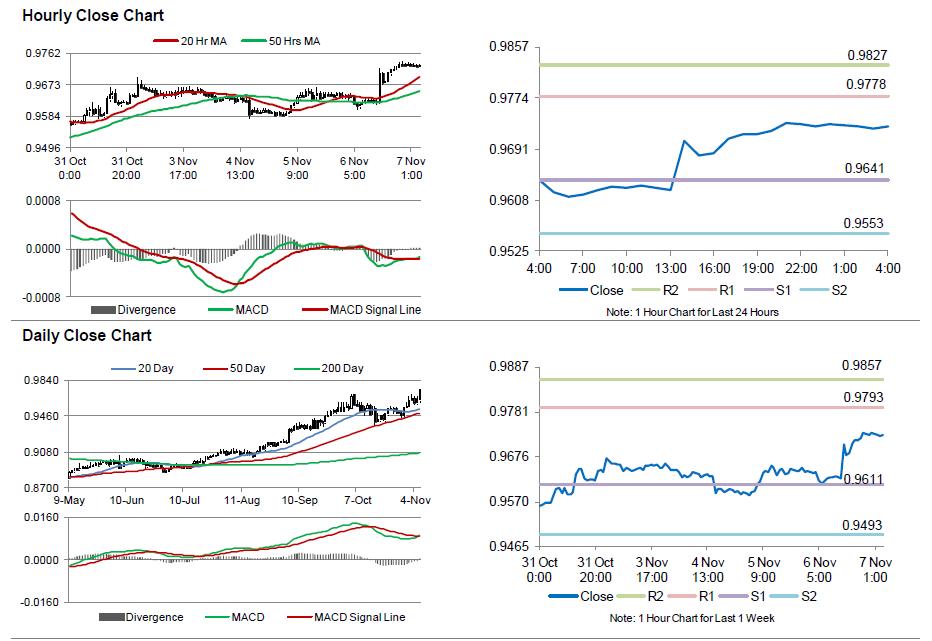

The pair is expected to find support at 0.9641, and a fall through could take it to the next support level of 0.9553. The pair is expected to find its first resistance at 0.9778, and a rise through could take it to the next resistance level of 0.9827.

Meanwhile, investor sentiments today would be governed by Switzerland’s unemployment rate data, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.