For the 24 hours to 23:00 GMT, the USD declined 0.36% against the CHF and closed at 0.9708, after the US consumer prices entered negative territory on a monthly basis in August.

The Swiss Franc strengthened, after the nation’s ZEW economic expectation index hit an 18-month high level of 9.7 in September, from August’s reading of 5.9, indicating positive signs for Switzerland’s export-heavy economy.

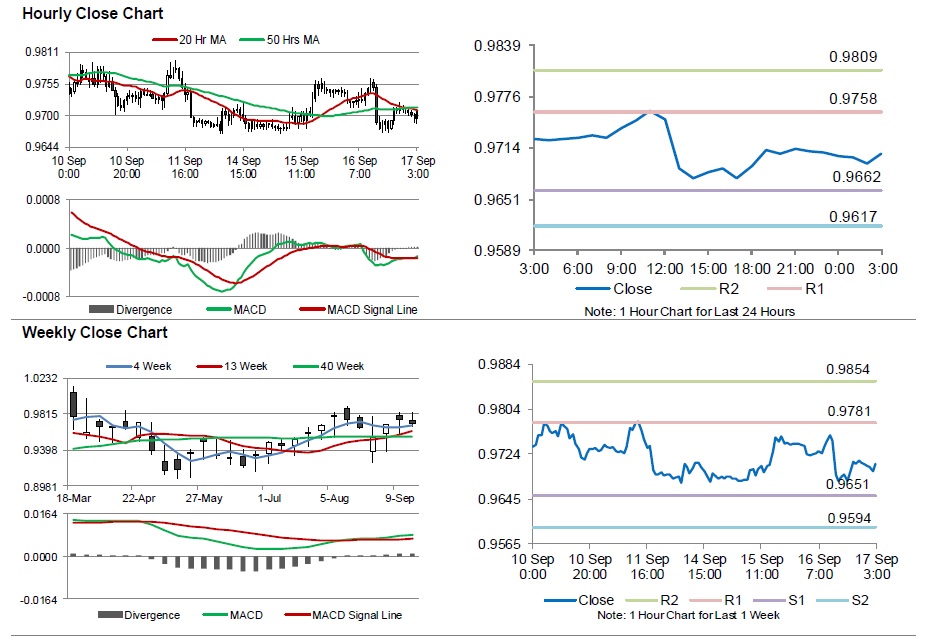

In the Asian session, at GMT0300, the pair is trading at 0.9707, with the USD trading flat from yesterday’s close.

The pair is expected to find support at 0.9662, and a fall through could take it to the next support level of 0.9617. The pair is expected to find its first resistance at 0.9758, and a rise through could take it to the next resistance level of 0.9809.

Going forward, the SNB’s interest rate decision, scheduled in a few hours would keep investors on their toes. Additionally, SECO’s September economic forecasts for the nation would also grab lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.