For the 24 hours to 23:00 GMT, the USD strengthened 0.15% against the JPY and closed at 120.57.

Yesterday, a leading global rating agency, downgraded Japan’s long-term credit rating to A+ from AA-, thus striking a heavy blow to the economic reforms adopted by the Japanese PM, Shinzo Abe to kickstart the nation’s struggling economy and conquer deflation.

In the Asian session, at GMT0300, the pair is trading at 120.51, with the USD trading marginally lower from yesterday’s close.

Overnight data indicated that Japan’s total merchandise trade deficit widened more than expected to ¥569.7 billion in August, compared to a deficit of ¥268.4 billion recorded in the previous month. Meanwhile, the nation’s exports advanced 3.1% YoY in August, lower than market expectations of a 4.0% gain. It followed an increase of 7.6% in July.

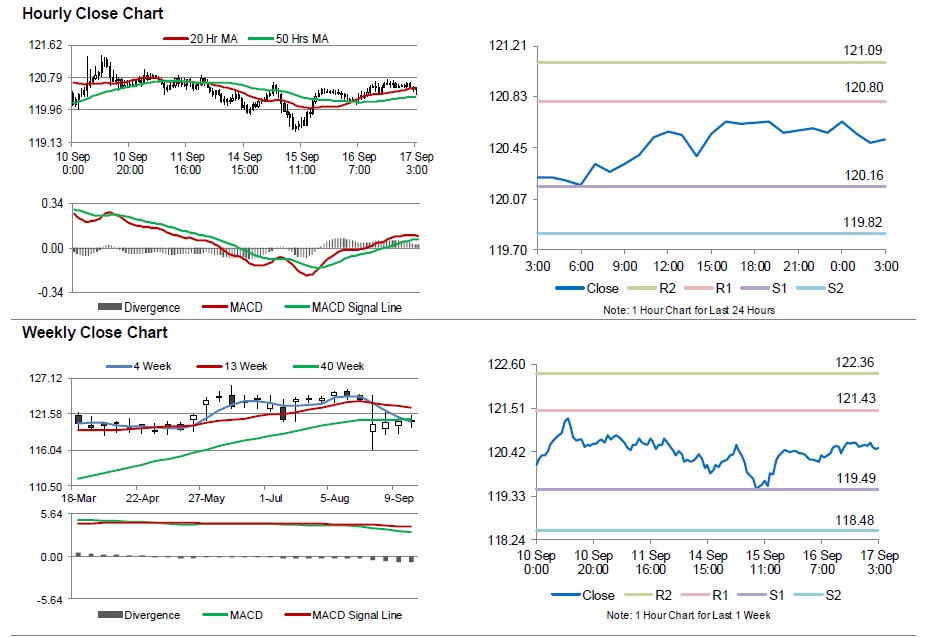

The pair is expected to find support at 120.16, and a fall through could take it to the next support level of 119.82. The pair is expected to find its first resistance at 120.8, and a rise through could take it to the next resistance level of 121.09.

Moving ahead, the BoJ Governor, Haruhiko Kuroda’s speech, scheduled in a few hours would be closely monitored by market participants, after the central bank refrained from injecting extra stimulus in the Japanese economy.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.