For the 24 hours to 23:00 GMT, the USD rose 0.45% against the CHF and closed at 0.9353. The Swiss Franc came under pressure, after retail sales in Switzerland fell unexpectedly at an annualized rate of 0.6% in July, compared to estimates for a 2.6% gain and an increase of 3.3% in the previous month.

In other economic data, the Swiss consumer price index (CPI) remained flat, on a monthly basis in August, higher than market expectations for a drop of 0.1%. The index had dropped 0.4% in the previous month. Meanwhile, the seasonally adjusted Swiss unemployment rate rose 3.2% in August, in line with market expectations. It follows a similar increase registered in the previous month.

In the Asian session, at GMT0300, the pair is trading at 0.9368, with the USD trading 0.16% higher from yesterday’s close.

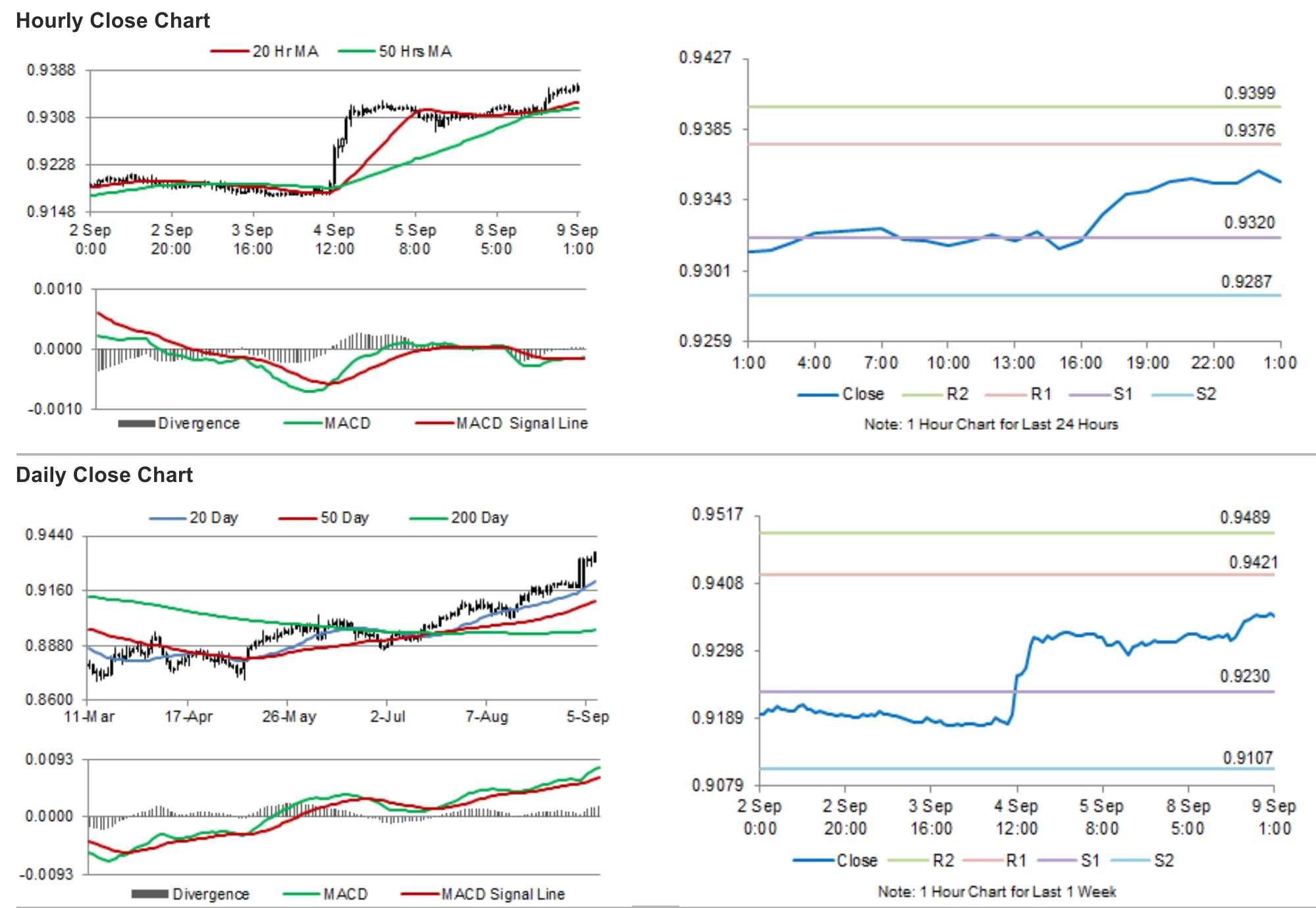

The pair is expected to find support at 0.9329, and a fall through could take it to the next support level of 0.9289. The pair is expected to find its first resistance at 0.939, and a rise through could take it to the next resistance level of 0.9411.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.