For the 24 hours to 23:00 GMT, the USD weakened 0.38% against the JPY and closed at 102.25, following a lacklustre US first-quarter GDP data.

Yesterday, following the BoJ’s decision to keep its monetary policy intact, the bank’s Governor reiterated that it would not hesitate to adjust its policy if risks materialise and pose a threat in meeting its price target while also adding that it would be too early to discuss the timings for the end of the central bank’s quantitative and qualitative easing policy. Furthermore, he revealed that three of the BoJ policymakers expressed dissent to the central bank’s semi-annual outlook report that forecasted high chances for the nation to achieve its 2.0% inflation target in the middle of the projection period. The BoJ’s semi-annual report also highlighted policymakers’ revised forecast for the Japanese economy which is expected to expand 1.1% in the fiscal year to next March, down from its earlier growth projection of 1.4%.

In economic news, housing starts in Japan declined 2.9% (YoY) in March, in-line with market expectation while construction orders dropped 8.8% in March, compared to a 12.3% increase in the previous month.

In the Asian session, at GMT0300, the pair is trading at 102.25, with the USD trading flat from yesterday’s close.

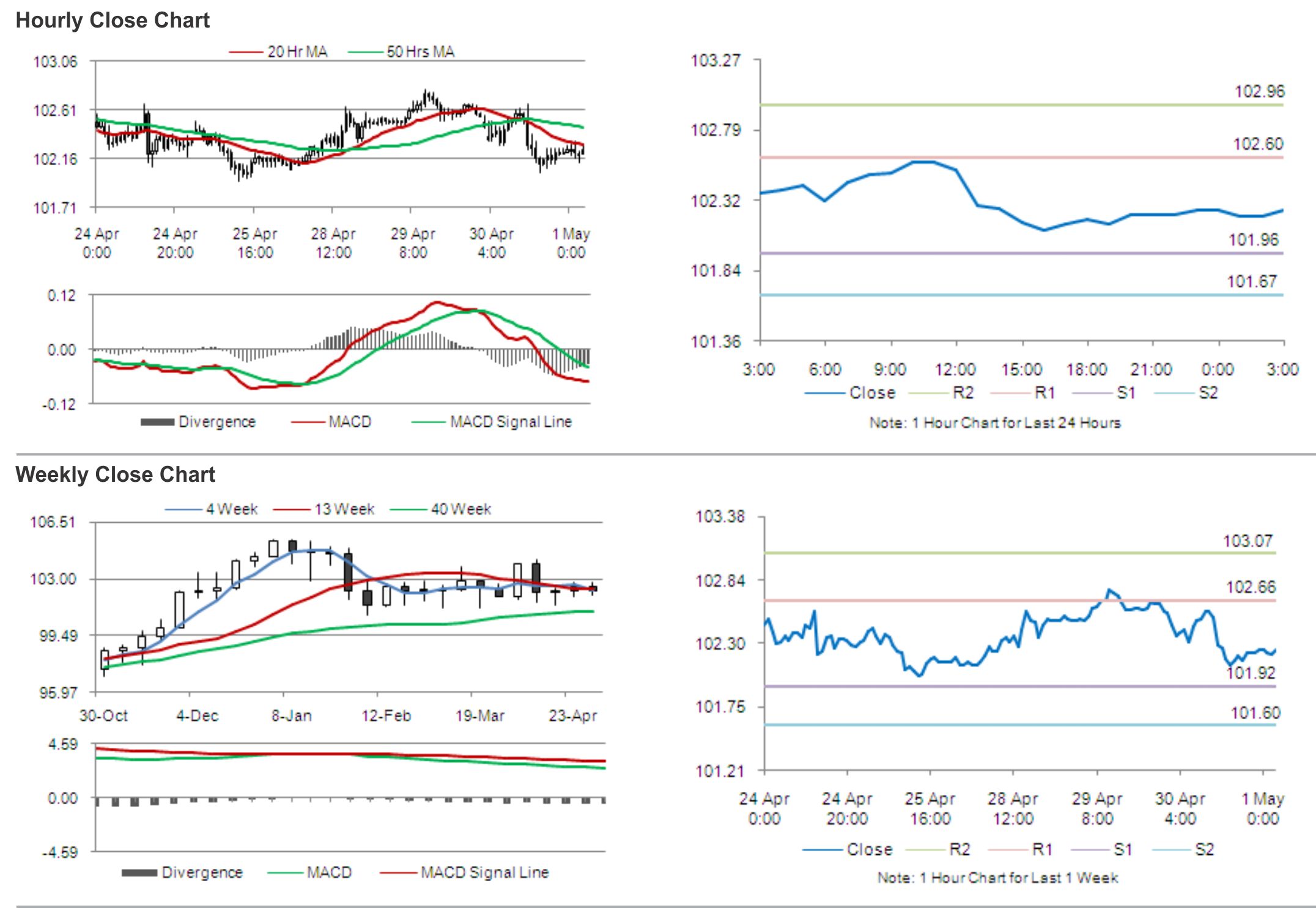

The pair is expected to find support at 101.96, and a fall through could take it to the next support level of 101.67. The pair is expected to find its first resistance at 102.60, and a rise through could take it to the next resistance level of 102.96.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.