For the 24 hours to 23:00 GMT, the USD declined 0.18% against the CHF and closed at 0.8933.

Earlier during the day, the Swiss France came under pressure after the Swiss consumer price inflation unexpectedly declined 0.1% in June (M-o-M), compared to a 0.3% rise reported in the previous month. Markets were expecting the consumer price index to increase 0.1% in June. Additionally, the nation’s real retail sales data too surprisingly dropped 0.6% in May, following a revised increase of 0.8% recorded in the preceding month. Markets were expecting retail sales to rise 1.5% in May.

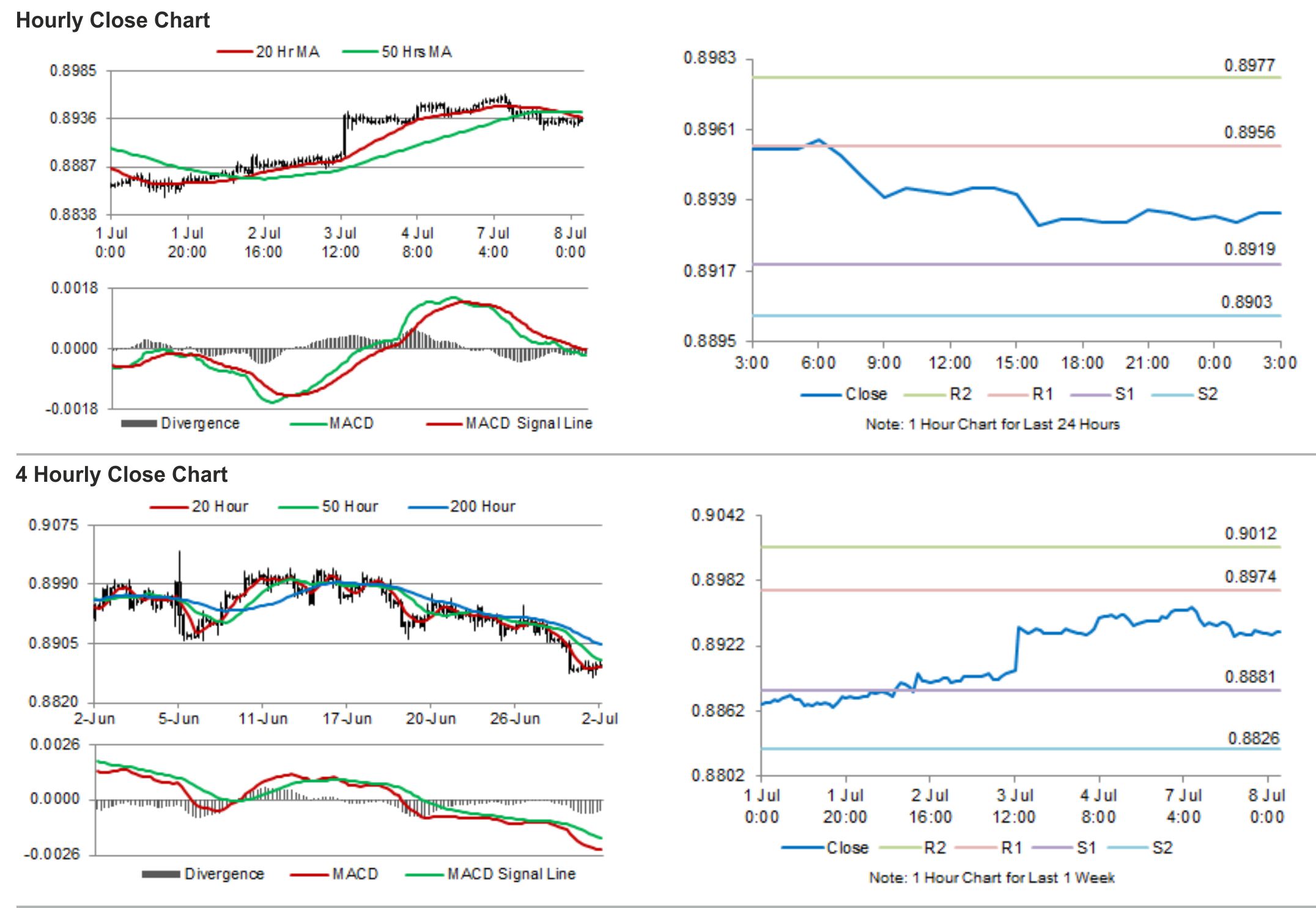

In the Asian session, at GMT0300, the pair is trading at 0.8935, with the USD trading tad higher from yesterday’s close.

The pair is expected to find support at 0.8919, and a fall through could take it to the next support level of 0.8903. The pair is expected to find its first resistance at 0.8956, and a rise through could take it to the next resistance level of 0.8977.

With no economic release scheduled during the day, trading trends in the pair today are expected to be determined by global factors.

The currency pair is showing convergence with its 20 Hr moving average and is trading slightly below its 50 Hr moving average.