For the 24 hours to 23:00 GMT, the USD weakened 0.26% against the JPY and closed at 101.84.

On the economic front, Japan’s economy watchers’ assessment of current conditions improved, while their expectations weakened in June.

The Eco Watchers Survey indicator for the current situation in Japan advanced to a level of 47.7 in June, compared to a reading of 45.1 reported in the previous month. Meanwhile, its index for the future outlook in Japan eased to a level of 53.3 in June, compared to a reading of 53.8 reported in the previous month. Separately, the corporate bankruptcies in Japan on a yearly basis declined 3.6% in June, following a decrease of 20.2% recorded in the preceding month. The BoJ Deputy Governor, Hiroshi Nakaso pledged that the central bank possessed the required mechanism to exit from its massive stimulus programme. However, he further added that it is too early to even discuss such a possibility, as uncertainty still remains whether the BoJ has reached its long term price stability target of 2% or not.

In the Asian session, at GMT0300, the pair is trading at 101.78, with the USD trading 0.07% lower from yesterday’s close.

Overnight, data released indicated that on an annual basis, M3 money supply in Japan climbed 2.4% in June, compared to a 2.6% increase in the previous month.

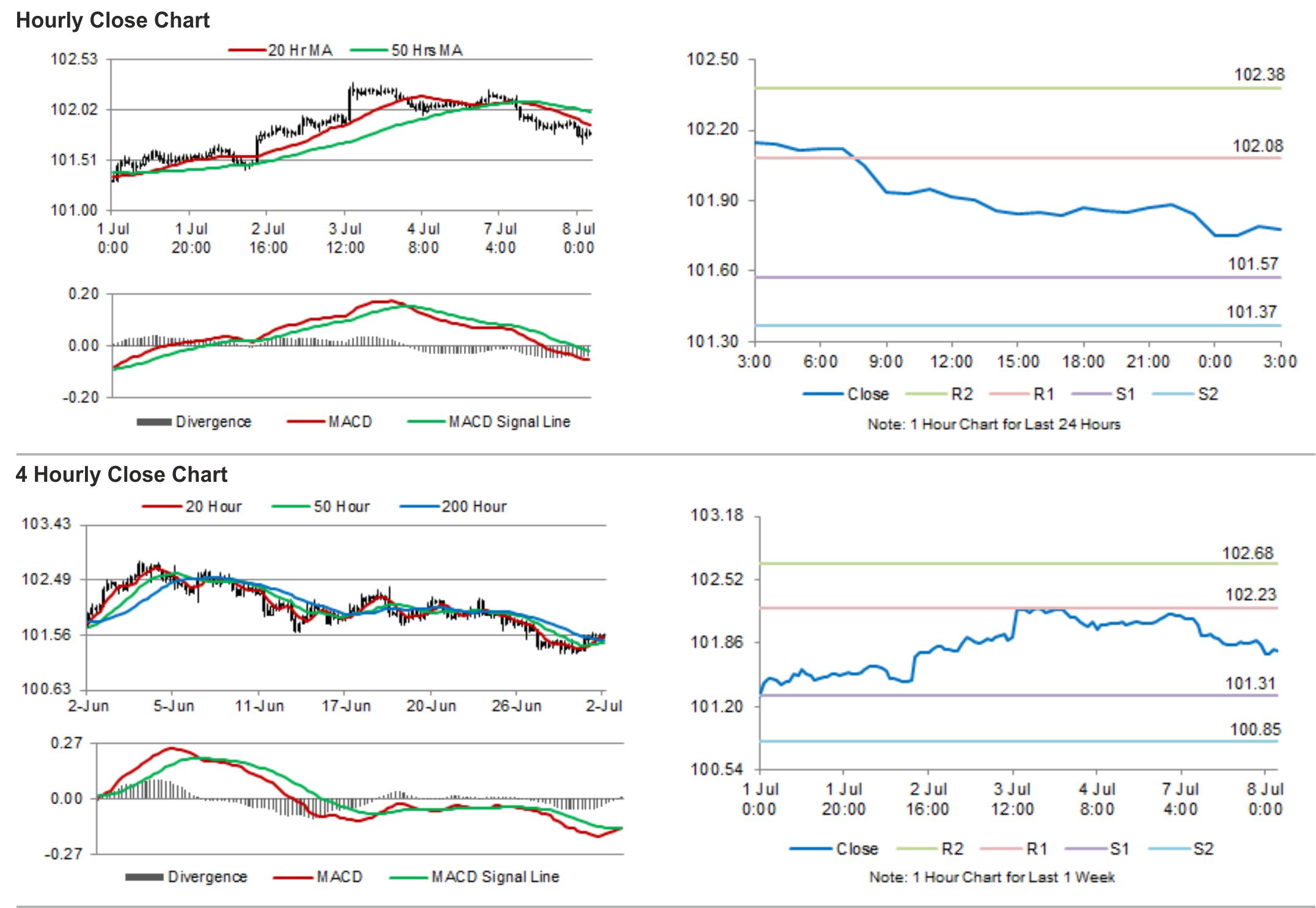

The pair is expected to find support at 101.57, and a fall through could take it to the next support level of 101.37. The pair is expected to find its first resistance at 102.08, and a rise through could take it to the next resistance level of 102.38.

Trading trends in the pair today are expected to be determined by data from machinery orders and Tertiary Industry Index, slated to release in the midnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.