For the 24 hours to 23:00 GMT, the USD declined 0.81% against the CHF and closed at 0.9918.

Yesterday, the Swiss National Bank Chairman, Thomas Jordan, cautioned that the central bank could not take “endless” steps to ease monetary policy conditions, thus hinting that it would refrain from making any further cuts to interest rates.

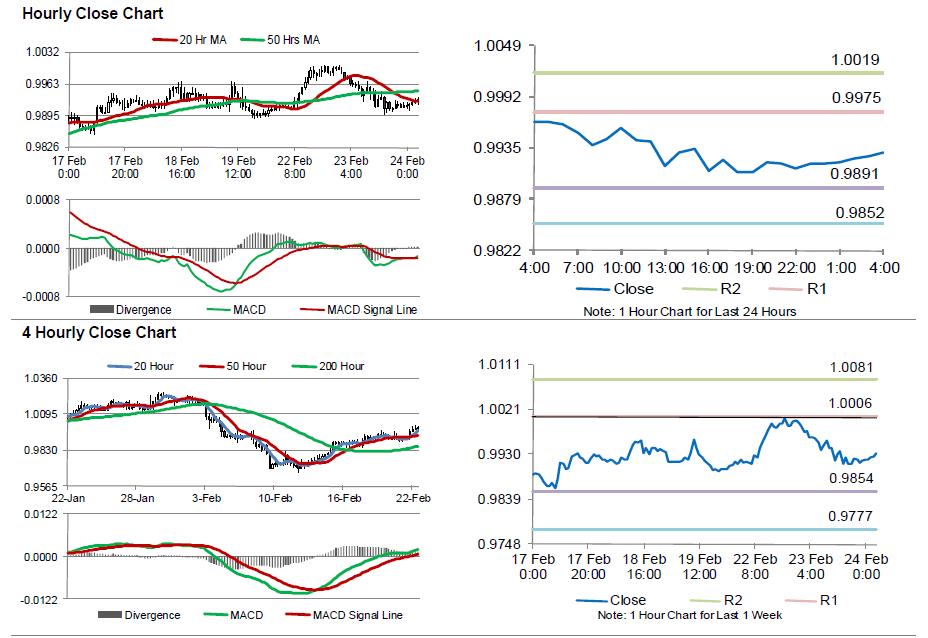

In the Asian session, at GMT0400, the pair is trading at 0.9931, with the USD trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 0.9891, and a fall through could take it to the next support level of 0.9852. The pair is expected to find its first resistance at 0.9975, and a rise through could take it to the next resistance level of 1.0019.

Going forward, investors will keep a close watch on Switzerland’s UBS consumption indicator data for January, due to be released in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.