For the 24 hours to 23:00 GMT, the USD declined 0.39% against the CHF and closed at 0.9614.

Yesterday, the Swiss National Bank’s (SNB) Governing Board member, Andrea Maechler, indicated that the central bank would not hesitate from dropping interest rates further into negative territory and added that the strong Swiss Franc continue to weigh on the nation’s economy.

In the Asian session, at GMT0300, the pair is trading at 0.961, with the USD trading marginally lower from yesterday’s close.

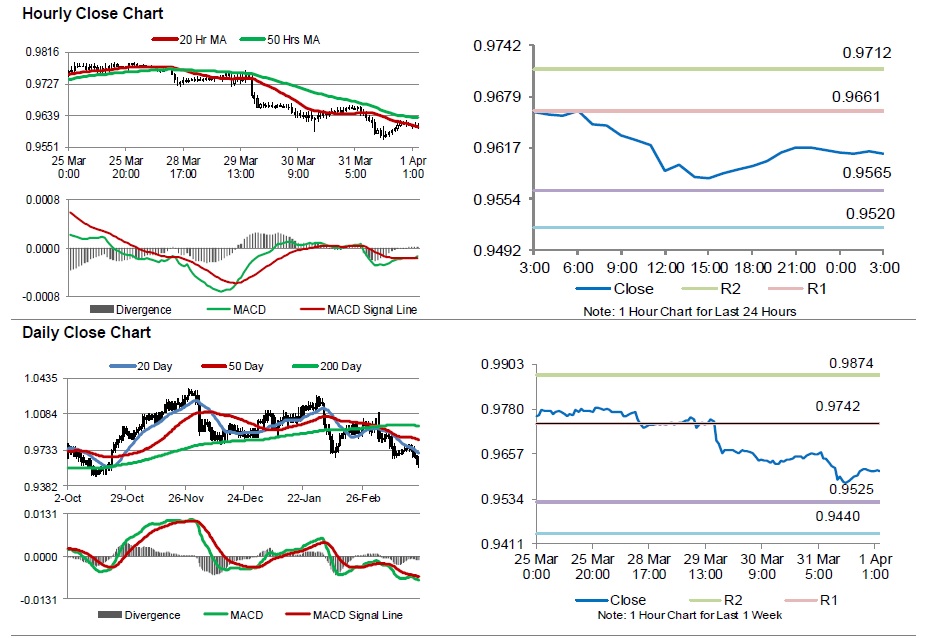

The pair is expected to find support at 0.9565, and a fall through could take it to the next support level of 0.9520. The pair is expected to find its first resistance at 0.9661, and a rise through could take it to the next resistance level of 0.9712.

Going ahead, investors will look forward to Switzerland’s real retail sales and SVME purchasing managers index data, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.