For the 24 hours to 23:00 GMT, the USD declined 1.35% against the CHF and closed at 0.9647.

In economic news, Swiss M3 money supply rose 2.3% YoY in February, down from prior month’s rise of 2.9%.

Separately, the IMF estimated that Swiss economic growth will ease to around 0.75% in 2015, mainly due to weaker exports. It also added that the nation’s economy would slow down more in the near term, while inflation would become negative.

In the Asian session, at GMT0400, the pair is trading at 0.9692, with the USD trading 0.47% higher from yesterday’s close.

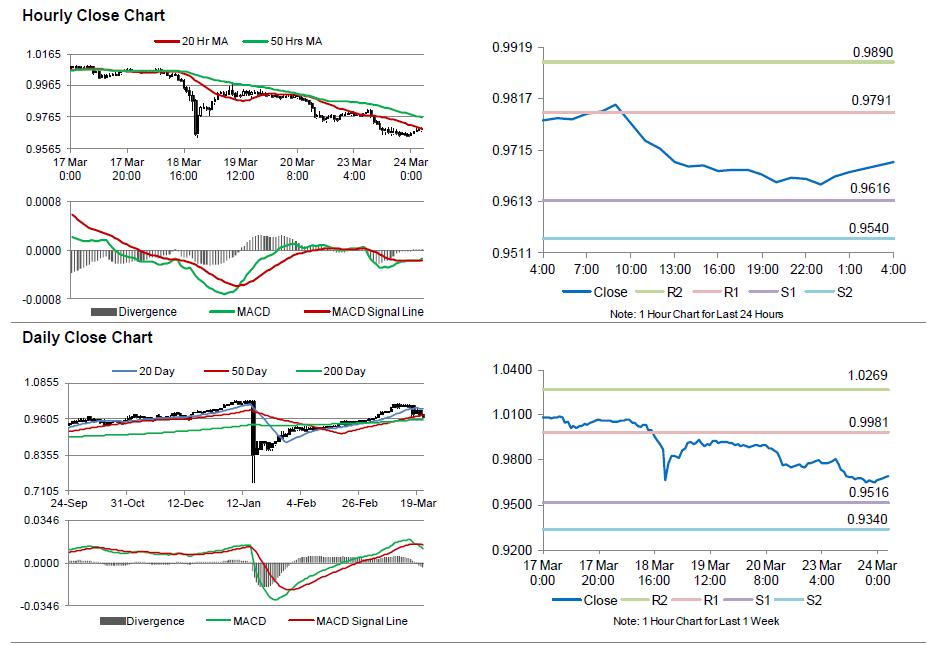

The pair is expected to find support at 0.9616, and a fall through could take it to the next support level of 0.9540. The pair is expected to find its first resistance at 0.9791, and a rise through could take it to the next resistance level of 0.9890.

Meanwhile, investors would monitor Switzerland’s UBS consumption indicator data, scheduled tomorrow, for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.