For the 24 hours to 23:00 GMT, the USD weakened 0.36% against the JPY and closed at 119.64.

Yesterday, the Japanese Government upgraded its assessment of Japan’s economy for the first time in eight months, citing improvement in corporate profits and improvement in industrial production.

In the Asian session, at GMT0400, the pair is trading at 119.78, with the USD trading 0.12% higher from yesterday’s close.

Earlier today, data showed that Japan’s preliminary Markit manufacturing PMI unexpectedly dropped to a level of 50.4 in March, compared to market expectations of a rise to a reading of 52.0 and following a level of 51.6 recorded in the preceding month.

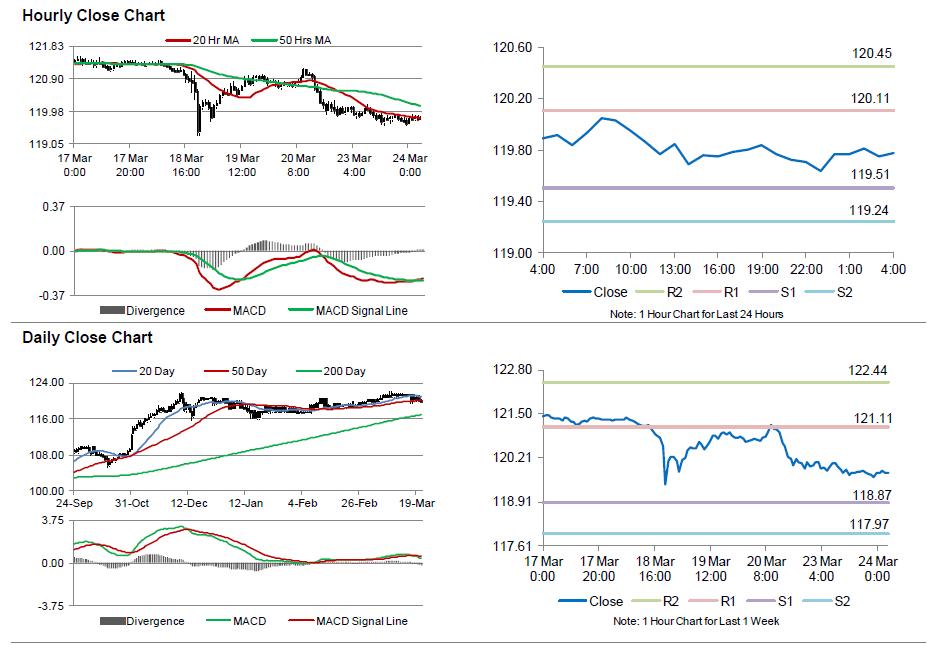

The pair is expected to find support at 119.51, and a fall through could take it to the next support level of 119.24. The pair is expected to find its first resistance at 120.11, and a rise through could take it to the next resistance level of 120.45.

Going forward, investors await the release of Japan’s national CPI and jobless rate data, scheduled on Thursday.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.