For the 24 hours to 23:00 GMT, the USD declined 0.24% against the CHF and closed at 0.9910.

On the data front, Switzerland’s trade surplus widened more-than-expected to CHF2.3 billion in April, after registering a revised surplus of CHF1.7 billion in the preceding month. Market participants had anticipated the nation’s trade surplus to widen to CHF2.2 billion.

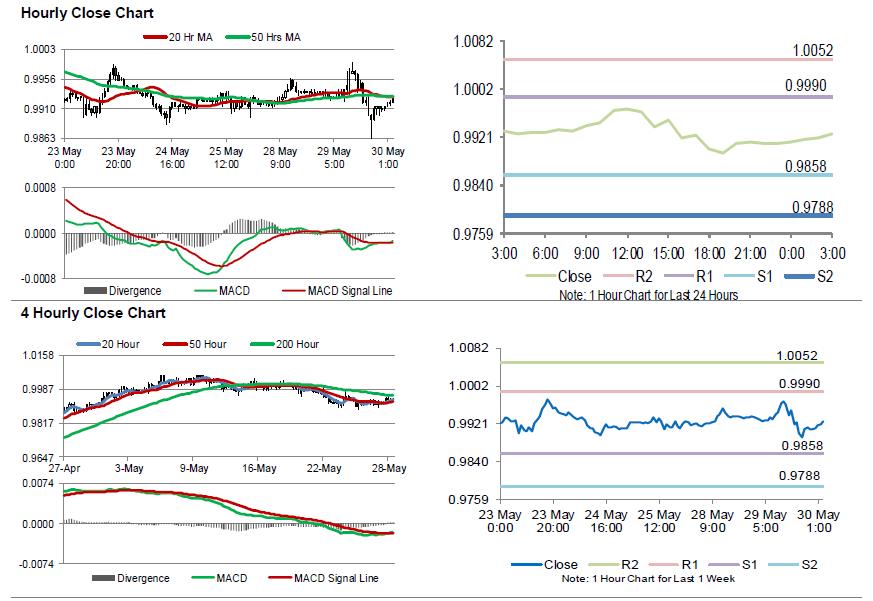

In the Asian session, at GMT0300, the pair is trading at 0.9927, with the USD trading 0.17% higher against the CHF from yesterday’s close.

The pair is expected to find support at 0.9858, and a fall through could take it to the next support level of 0.9788. The pair is expected to find its first resistance at 0.9990, and a rise through could take it to the next resistance level of 1.0052.

Moving ahead, traders would closely monitor Switzerland’s ZEW expectations index and KOF leading indicator for May, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.