For the 24 hours to 23:00 GMT, the USD declined 0.78% against the JPY and closed at 108.58.

The Japanese Yen gained ground against the USD, as political turmoil in Italy boosted demand for the safe haven currency.

In the Asian session, at GMT0300, the pair is trading at 108.61, with the USD trading slightly higher against the JPY from yesterday’s close.

Overnight data indicated that Japan’s retail trade rebounded 1.4% a monthly basis in April, beating market expectations for a rise of 0.5%. In the prior month, retail trade had recorded a drop of 0.7%. On the other hand, the nation’s large retailers’ sales unexpectedly dropped 0.8% on a monthly basis in April, confounding market consensus for an advance of 0.2%. Large retailers’ sales had registered a revised similar rise in the prior month.

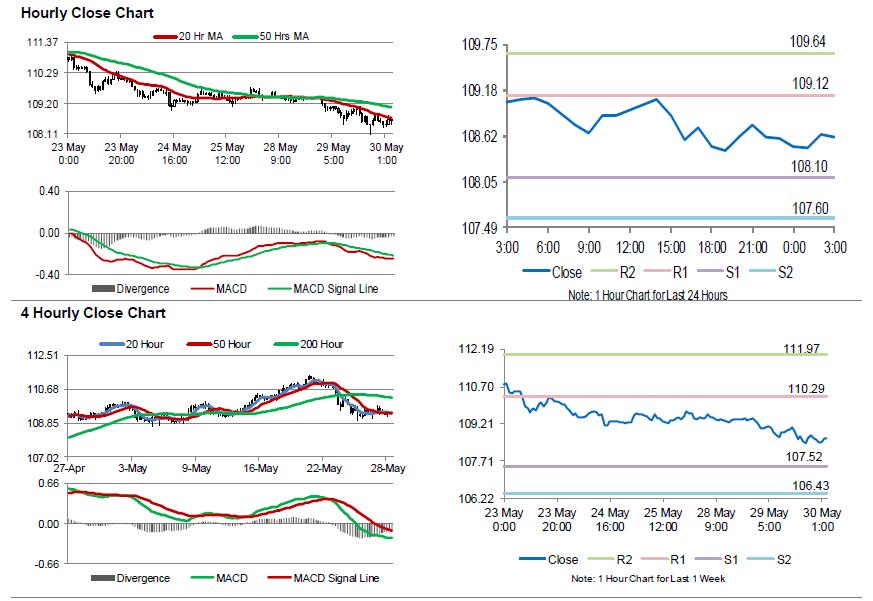

The pair is expected to find support at 108.10, and a fall through could take it to the next support level of 107.60. The pair is expected to find its first resistance at 109.12, and a rise through could take it to the next resistance level of 109.64.

Going ahead, market participants would focus on Japan’s industrial production data for April, due to release overnight.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.