For the 24 hours to 23:00 GMT, the USD weakened 0.24% against the JPY and closed at 103.07.

In economic news, Japan’s leading economic indicator fell more-than-expected to a 5-month low reading of 108.5 in February, from previous month’s level of 113.1. Likewise, the coincident index in Japan also registered a fall to a level of 113.4 in February, in-line with market estimates and compared to a reading of 115.2 in the preceding month.

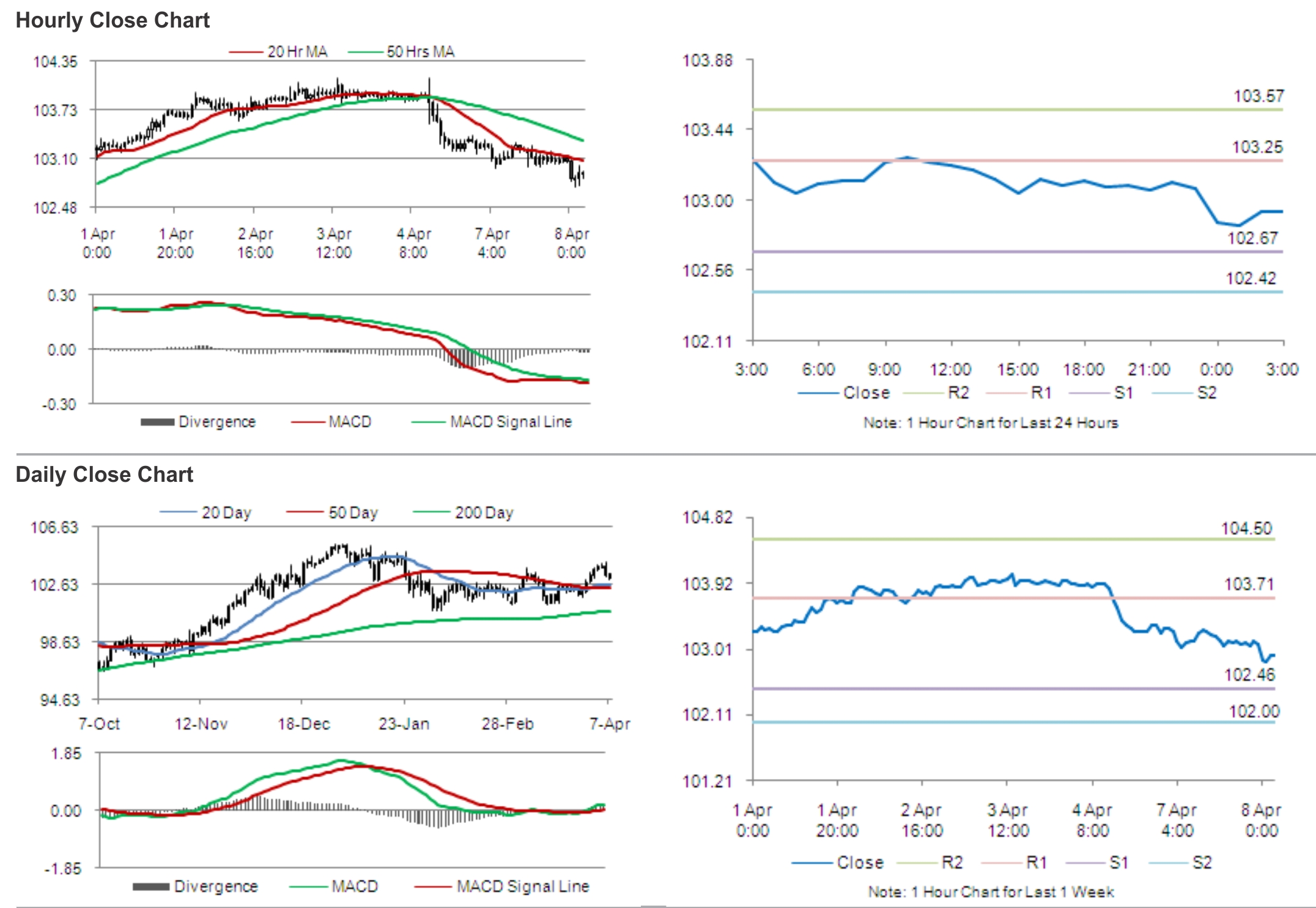

In the Asian session, at GMT0300, the pair is trading at 102.93, with the USD trading 0.14% lower from yesterday’s close.

The Japanese Yen rose after the Bank of Japan (BoJ), at its two-day policy meeting, refrained from adding extra-stimulus to the economy post a sales tax hike in April and maintained its view for economic recovery in Japan to likely continue at a moderate pace. The central bank also kept its monetary policy steady, by keeping its interest rate unchanged at 0.1% and pledging to expand the monetary base at a pace of ¥60 trillion to ¥70 trillion per year.

The pair is expected to find support at 102.67, and a fall through could take it to the next support level of 102.42. The pair is expected to find its first resistance at 103.25, and a rise through could take it to the next resistance level of 103.57.

Market participants await the BoJ Governor, Haruhiko Kuroda’s press conference, due later today, for further cues in the Yen. Also later today, Japan’s Cabinet Office is scheduled to publish its survey on the current and the economic outlook for the Japanese economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.