For the 24 hours to 23:00 GMT, the USD weakened 0.18% against the JPY and closed at 120.22.

Yesterday, the IMF trimmed its growth forecast for Japan to 0.6% in 2015, from its earlier forecast of 0.8%. For 2016, it predicted that Japan would grow at 1.0%, down from its earlier forecast of 1.2%

In the Asian session, at GMT0300, the pair is trading at 120.03, with the USD trading 0.16% lower from yesterday’s close.

Earlier today, the BoJ kept its monetary policy steady. The central bank in its monetary policy statement announced that it will maintain its pledge to increase base money at an annual pace of ¥80 trillion by way of aggressive asset purchases, despite the nation’s tumbling exports and sliding oil prices

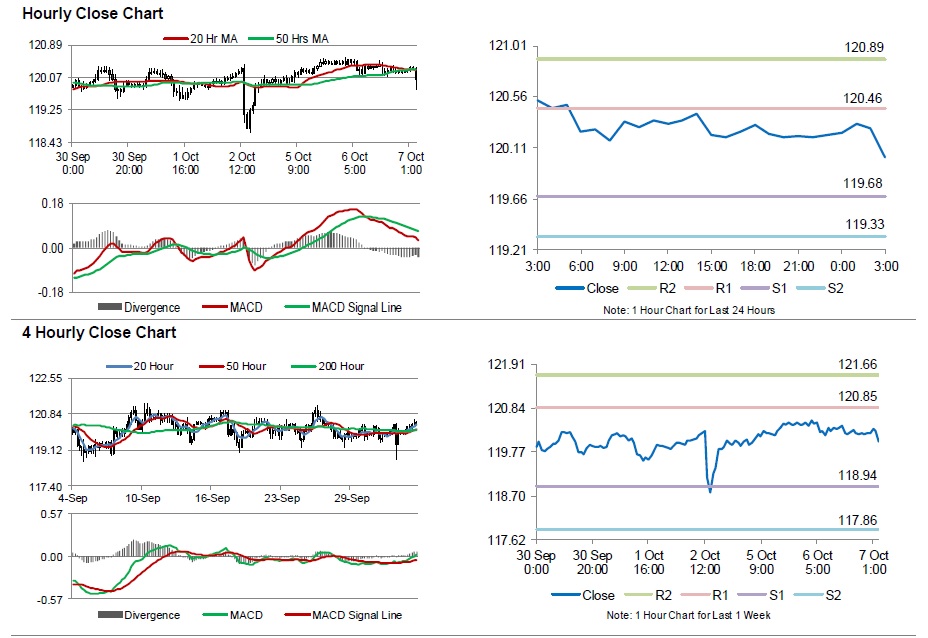

The pair is expected to find support at 119.68, and a fall through could take it to the next support level of 119.33. The pair is expected to find its first resistance at 120.46, and a rise through could take it to the next resistance level of 120.89.

Looking forward, the BoJ Governor, Haruhiko Kuroda’s press conference this afternoon would be closely watched by market participants to gauge to strength of the Japanese economy.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.