For the 24 hours to 23:00 GMT, the USD strengthened 0.13% against the JPY and closed at 102.63. The Japanese Yen declined as traders speculated that the recent rally in the safe-haven currency on the back of Ukraine crisis was overdone.

In the Asian session, at GMT0300, the pair is trading at 102.34, with the USD trading 0.28% lower from yesterday’s close. Earlier today, the Bank of Japan, at its two-day policy meeting in April, refrained from altering its monetary stance by keeping its interest rate at 0.1% and maintaining its pledge to increase its monetary base by ¥60-70 trillion a year.

On the economic front, industrial production in Japan rebounded 0.3% (MoM) for the first rise in two months in March, however, the rise in Japan’s industrial production failed to meet market expectation for a rise of 0.5%. Separately, the Nomura/JMMA manufacturing purchasing manager index fell to a reading of 49.4 in April, from previous month’s level of 53.9.

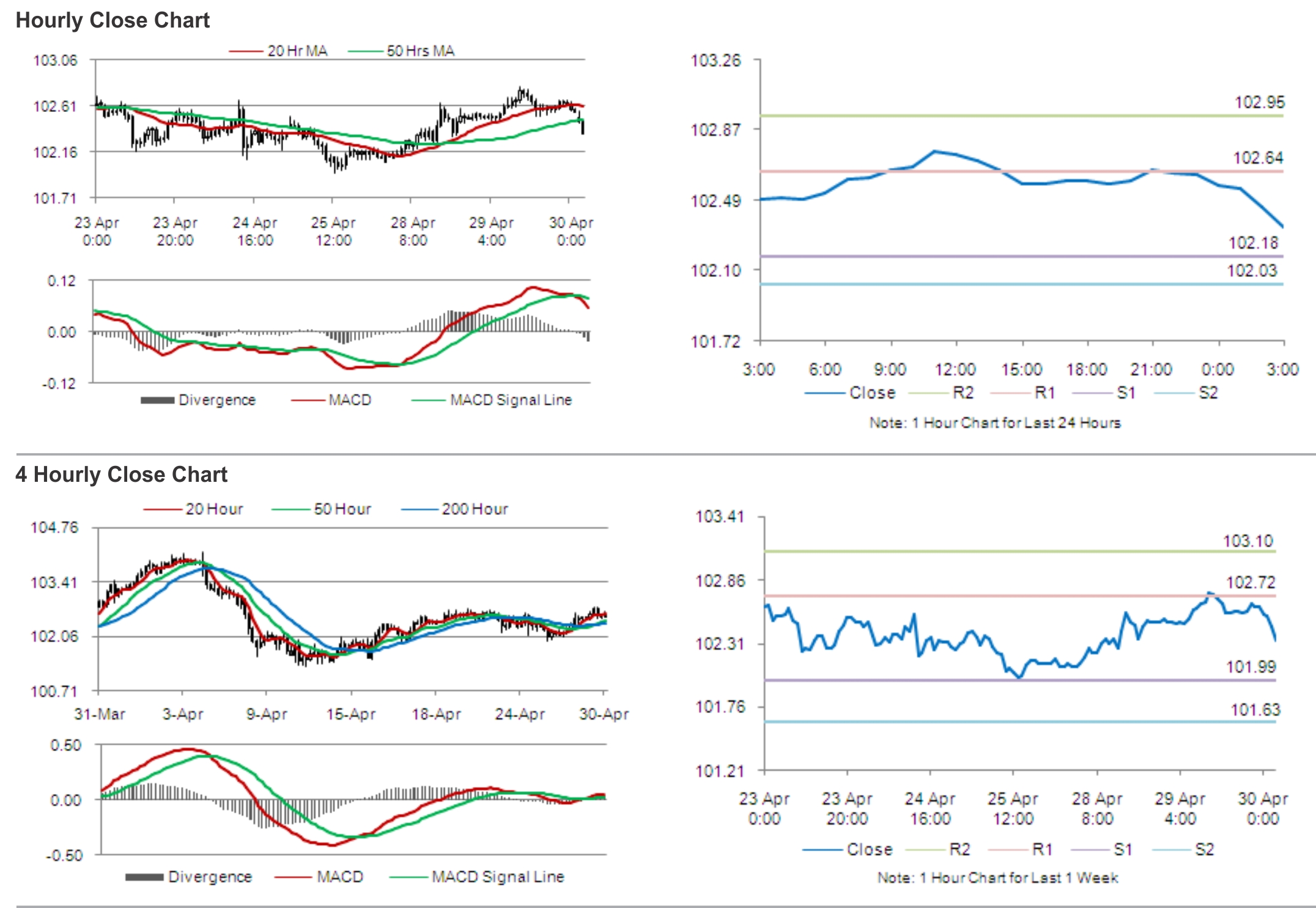

The pair is expected to find support at 102.18, and a fall through could take it to the next support level of 102.03. The pair is expected to find its first resistance at 102.64, and a rise through could take it to the next resistance level of 102.95.

During the later course of the day, traders would eye the BoJ’s press conference and Japan’s releases on housing starts and construction order.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.