For the 24 hours to 23:00 GMT, the USD weakened 0.26% against the JPY and closed at 101.84.

Yesterday, the BoJ, in its quarterly report, held on to its upbeat assessment on all the nine regions in Japan, adding that the nation’s recovery was on track without any additional stimulus programme. However, the BoJ Governor, Haruhiko Kuroda reiterated that the central bank would not do away with its current massive stimulus programme to assist the nation in its path to achieve 2.0% inflation target.

In the Asian session, at GMT0300, the pair is trading at 101.78, with the USD trading 0.07% lower from yesterday’s close.

The Japanese Yen was buoyed after trade deficit in Japan unexpectedly narrowed to ¥675.9 billion in May from a deficit of ¥780.4 billion recorded in the previous month. Markets had expected the trade deficit to widen to ¥822.5 billion in May. Additionally, the nation posted a current account surplus for the fourth consecutive month in May. Further, the overall bank lending rate in Japan edged up slightly in June.

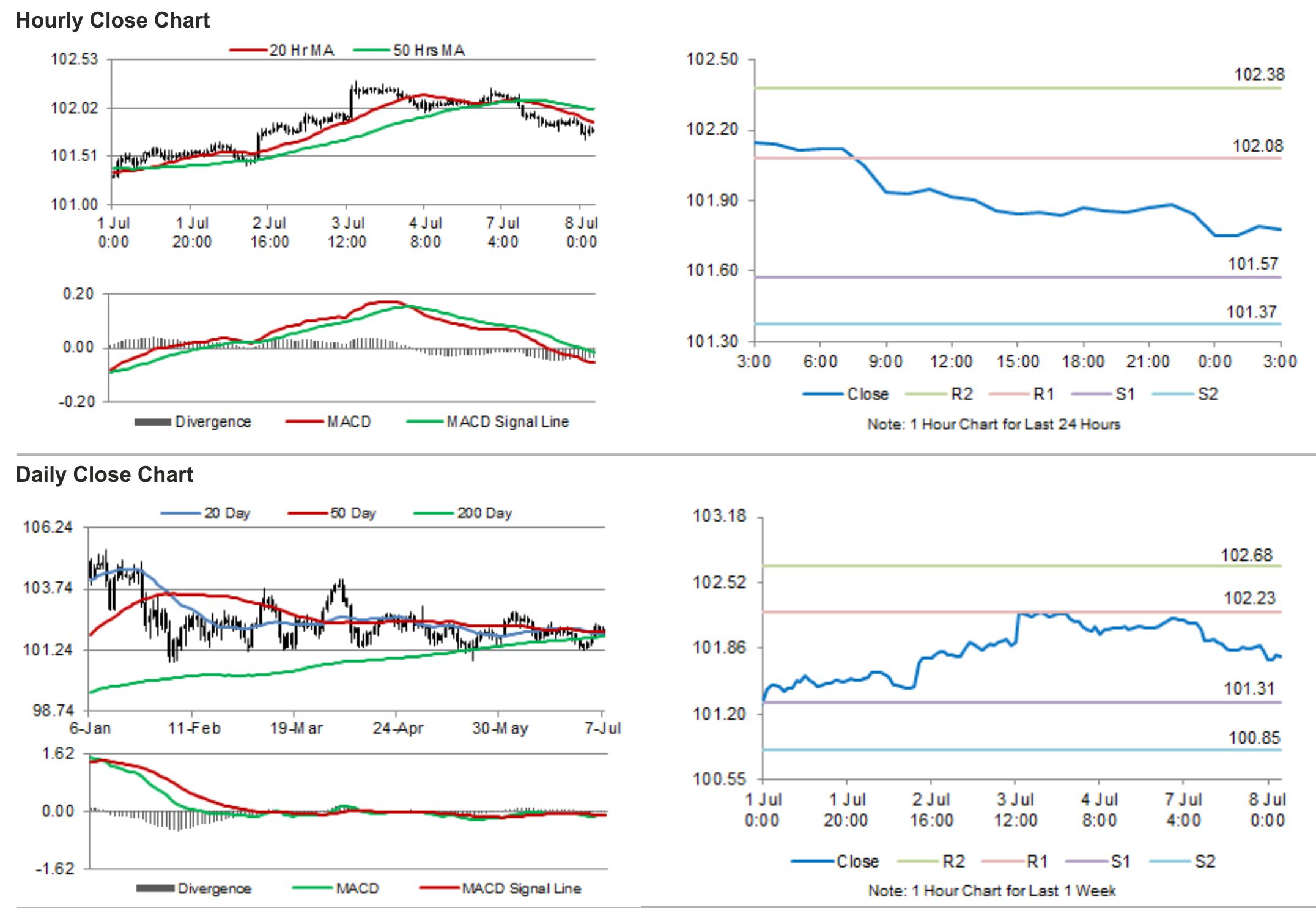

The pair is expected to find support at 101.57, and a fall through could take it to the next support level of 101.37. The pair is expected to find its first resistance at 102.08, and a rise through could take it to the next resistance level of 102.38.

Investors would pay close attention to Japan’s economy watchers’ assessment of current conditions and their expectations for June scheduled to release later during the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.