For the 24 hours to 23:00 GMT, the USD rose 1.15% against the JPY and closed at 102.83.

Yesterday, the IMF revised its outlook for Japan’s economy for 2016 and 2017, pointing to huge government stimulus spending, but also warned that the nation’s longer-term prospects were discouraging. The Fund now expects the Japanese economy to expand by 0.5% and 0.6% in 2016 and 2017 respectively, up from a July forecast of 0.3% and 0.1% respectively.

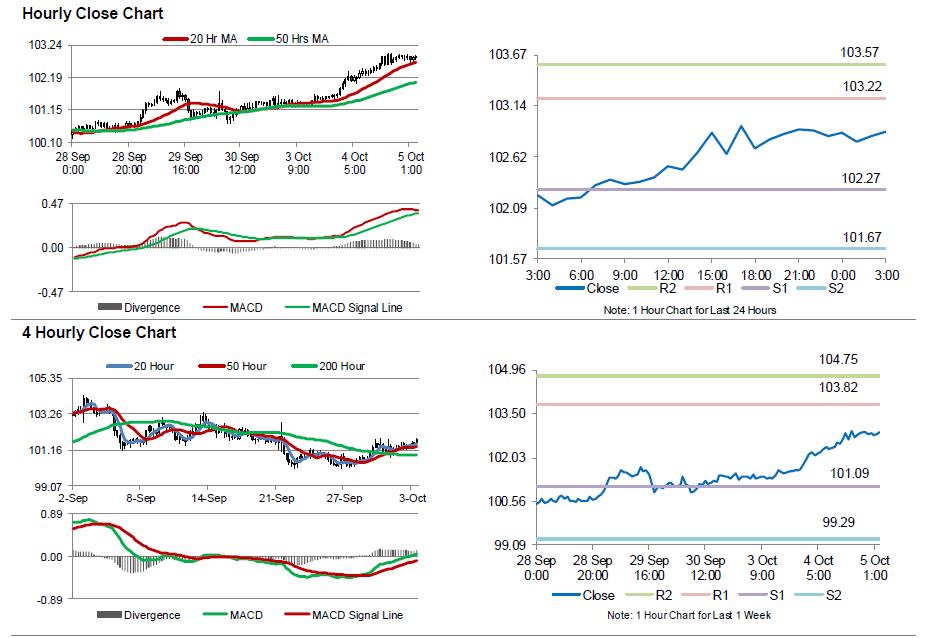

In the Asian session, at GMT0300, the pair is trading at 102.88, with the USD trading marginally higher against the JPY from yesterday’s close.

Overnight data indicated that, Japan’s Nikkei services PMI fell to a level of 48.2 in September, following a level of 49.6 in the previous month, indicating that the nation is struggling to gain momentum.

The pair is expected to find support at 102.27, and a fall through could take it to the next support level of 101.67. The pair is expected to find its first resistance at 103.22, and a rise through could take it to the next resistance level of 103.57.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.