For the 24 hours to 23:00 GMT, the USD strengthened 0.28% against the JPY and closed at 103.15.

In economic news, Japan’s housing starts rose 9.8% YoY in May, higher than market expectations for an advance of 4.8%. In the prior month, housing starts had advanced 9.0%.

In the Asian session, at GMT0300, the pair is trading at 102.88, with the USD trading 0.26% lower from yesterday’s close.

Overnight data showed that Japan’s national consumer price index (CPI) fell less-than-expected by 0.4% YoY in May, following a 0.3% drop in the previous month. Additionally, the nation’s unemployment rate held steady at 3.2% in May, in line with market expectations.

In other economic news, Japan’s Tankan large manufacturers’ index remained steady at a level of 6.0 in 2Q 2016. Further, the nation’s non-manufacturing index fell to a level of 19.0, from a reading of 22.0 in the previous quarter. However, the large manufacturers’ outlook index surprisingly rose to a level of 6.0 in 2Q 2016, from a level of 3.0 in the prior quarter.

Early this morning, Japan’s final Nikkei manufacturing PMI rose to a level of 48.1 in June, from a preliminary reading of 47.8.

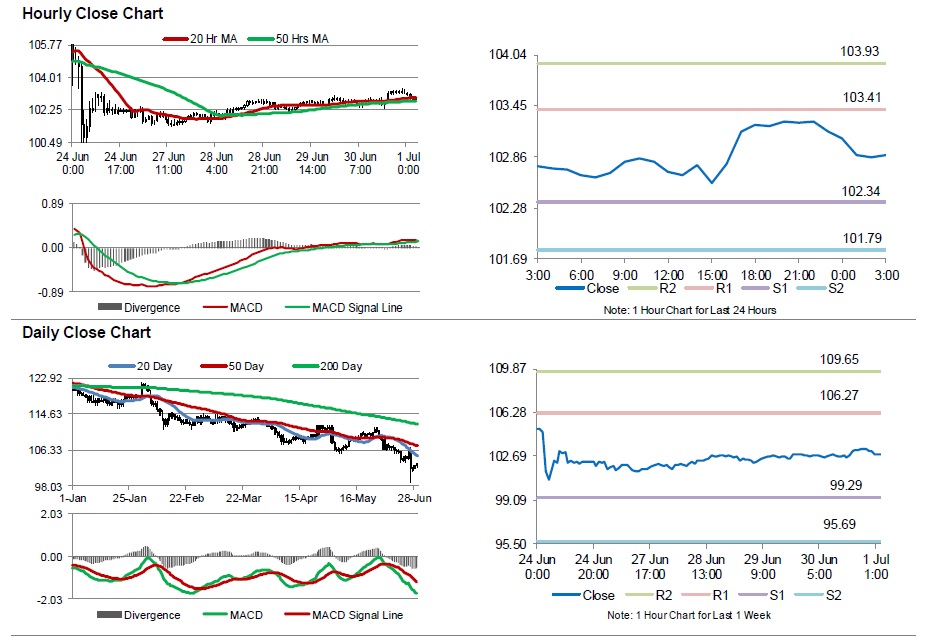

The pair is expected to find support at 102.34, and a fall through could take it to the next support level of 101.79. The pair is expected to find its first resistance at 103.41, and a rise through could take it to the next resistance level of 103.93.

Going ahead, investors will look forward to Japan’s trade balance, Nikkei services PMI and the Eco watchers survey data, all scheduled for release next week.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.