On Friday, the USD strengthened 2.68% against the JPY and closed at 112.24 The Japanese currency lost ground and traded at almost 6-year low after the BoJ surprised markets by expanding its monetary base at an annual pace of about ¥80.0 trillion, compared to ¥60-70 trillion earlier. Additionally, the central bank in its semi annual economic outlook report lowered the nation’s real GDP growth rate to 0.5% for FY2014-15 from a growth rate of 1.0% projected in July, citing weak exports and slower consumer spending after a sales tax rise in April 2014. Meanwhile, it anticipates that the central bank would be able to meet its inflation target within the two-year timeframe which it had originally planned.

In the Asian session, at GMT0400, the pair is trading at 112.74, with the USD trading 0.44% higher from Friday’s close.

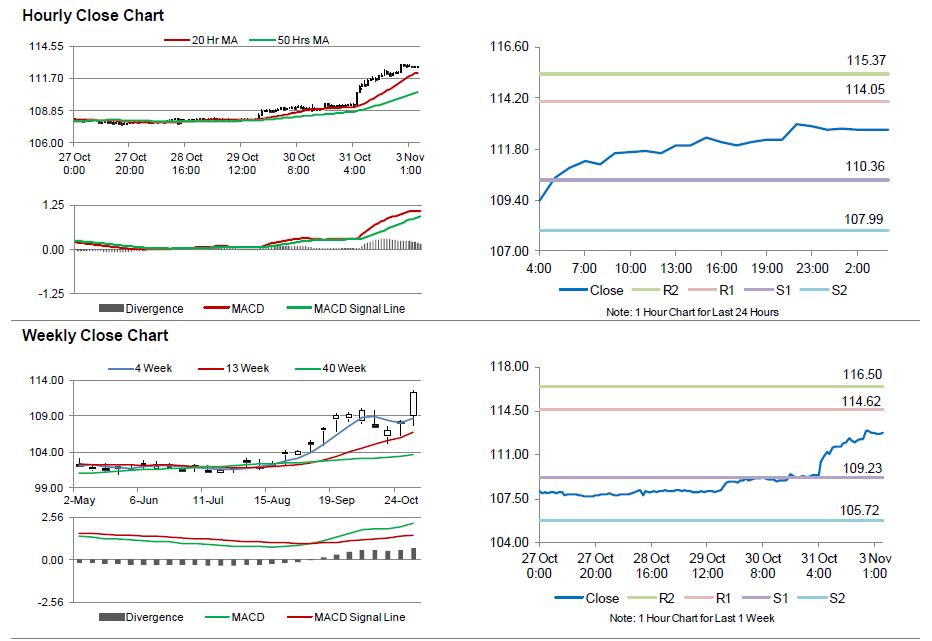

The pair is expected to find support at 110.36, and a fall through could take it to the next support level of 107.99. The pair is expected to find its first resistance at 114.05, and a rise through could take it to the next resistance level of 115.37.

Going further, traders look forward to Japan’s manufacturing PMI data, scheduled tomorrow early morning.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.