For the 24 hours to 23:00 GMT, the USD strengthened 0.28% against the JPY and closed at 124.33.

Yesterday, Etsuro Honda, a special economic adviser to Japan’s Prime Minister said that he feels there is no need for the central bank to deploy additional stimulus to meet its 2.0% inflation goal next year, as it could cause the Yen to weaken and prices to rise.

In the Asian session, at GMT0300, the pair is trading at 124.41, with the USD trading 0.06% higher from yesterday’s close.

Earlier today, data revealed that Japan’s services PMI dropped to a seasonally adjusted 51.2 in July from 51.8 in June.

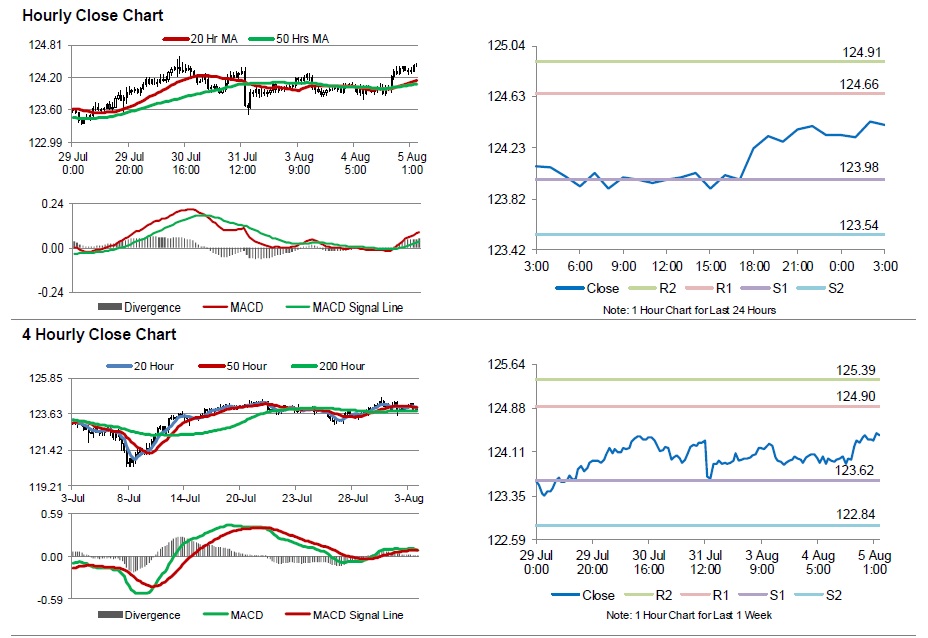

The pair is expected to find support at 123.98, and a fall through could take it to the next support level of 123.54. The pair is expected to find its first resistance at 124.66, and a rise through could take it to the next resistance level of 124.91.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.