For the 24 hours to 23:00 GMT, the USD weakened 0.41% against the JPY and closed at 118.30.

Yesterday, Global rating agency, Moody’s highlighted its concerns over Japan’s ability to reduce its debt level and downgraded its credit rating on the nation by one notch to “A1” from “Aa3”, with a “Stable” outlook.

In other economic news, Japan’s vehicle sales fell 13.5% on an annual basis in November, compared to a drop of 9.1% recorded in the prior month.

In the Asian session, at GMT0400, the pair is trading at 118.43, with the USD trading 0.11% higher from yesterday’s close.

Earlier today, data from Japan indicated that labour cash earnings climbed 0.5% on a YoY basis in October, lower than market expectations for an advance of 0.8%. In the prior month, labour cash earnings had risen by a revised 0.7%.

Overnight data showed that monetary base in Japan rose 36.7% in November, compared to an increase of 36.9% registered in the prior month.

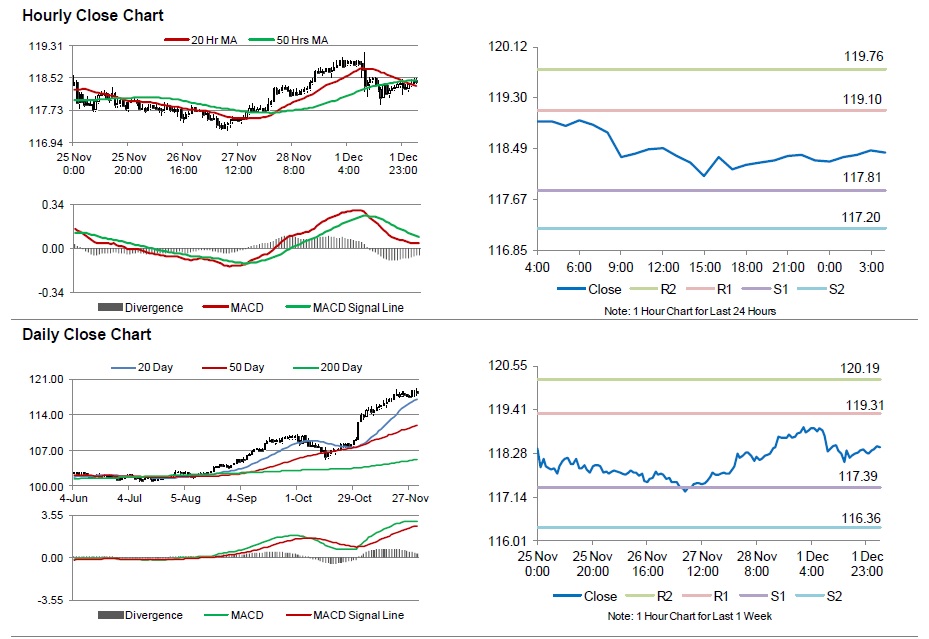

The pair is expected to find support at 117.81, and a fall through could take it to the next support level of 117.20. The pair is expected to find its first resistance at 119.10, and a rise through could take it to the next resistance level of 119.76.

Meanwhile, investors look forward to Japan’s services PMI data for further cues, scheduled in the early hours tomorrow.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.