For the 24 hours to 23:00 GMT, the USD strengthened 0.08% against the JPY and closed at 101.60.

On the economic front, the preliminary machine tool orders on an annualised basis rose 34.2% in June, compared to a 24.1% increase recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 101.52, with the USD trading 0.08% lower from yesterday’s close.

Data released overnight revealed that the machinery orders in Japan on a monthly basis plunged 19.5% in May, compared to a 9.1% fall recorded in the previous month. Markets were expecting machinery orders to rise 0.7% in May. Meanwhile, the tertiary industry index in the nation rose at a slower than expected pace 0.9% in May, compared to a revised 5.7% decline recorded in the previous month. Markets were expecting the tertiary industry index to climb 1.7% in May.

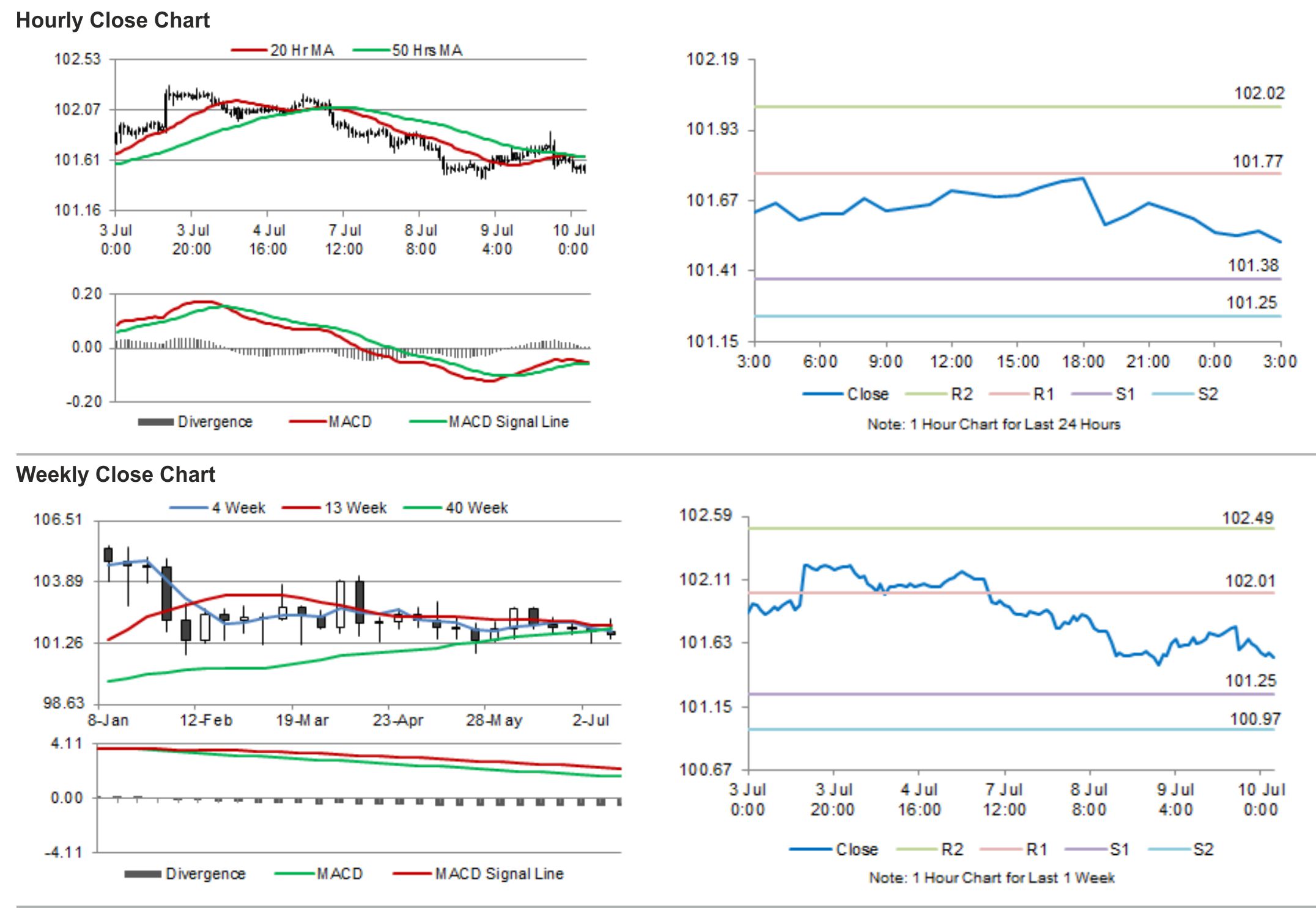

The pair is expected to find support at 101.38, and a fall through could take it to the next support level of 101.25. The pair is expected to find its first resistance at 101.77, and a rise through could take it to the next resistance level of 102.02.

Going forward, investors would pay attention to the release of Japan’s consumer confidence data for the month of June.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.