For the 24 hours to 23:00 GMT, the USD weakened 0.42% against the JPY and closed at 118.72, as the Fed in its minutes did not shed any light on the exact timing of interest rate hike in the US.

Yesterday, the BoJ Governor, Haruhiko Kuroda, reiterated that the bank will continue with its quantitative easing programme for as long as necessary to achieve its 2% inflation target.

In the Asian session, at GMT0400, the pair is trading at 118.62, with the USD trading 0.09% lower from yesterday’s close.

Early morning data showed that Japan’s exports unexpectedly climbed 17.0% on an annual basis, marking its biggest rise since late 2013 in January and compared to prior month’s rise of 12.8%, thus boosting the Japanese economy. Meanwhile, imports retreated more than expected by 9.0% YoY in January, against a 4.8% expected fall.

Overnight data indicated that Japan’s adjusted merchandise trade deficit dropped to ¥406.10 billion in January, from a revised trade deficit of ¥620.70 billion in the prior month. Market anticipations were for the nation to record an adjusted merchandise trade deficit of ¥598.10 billion.

In other economic news, Japan’s all industry activity index dropped 0.3% on a monthly basis in December, compared to a rise of 0.1% registered in the prior month. On the other hand, the nation’s leading as well as coincident indices edged up in December respectively.

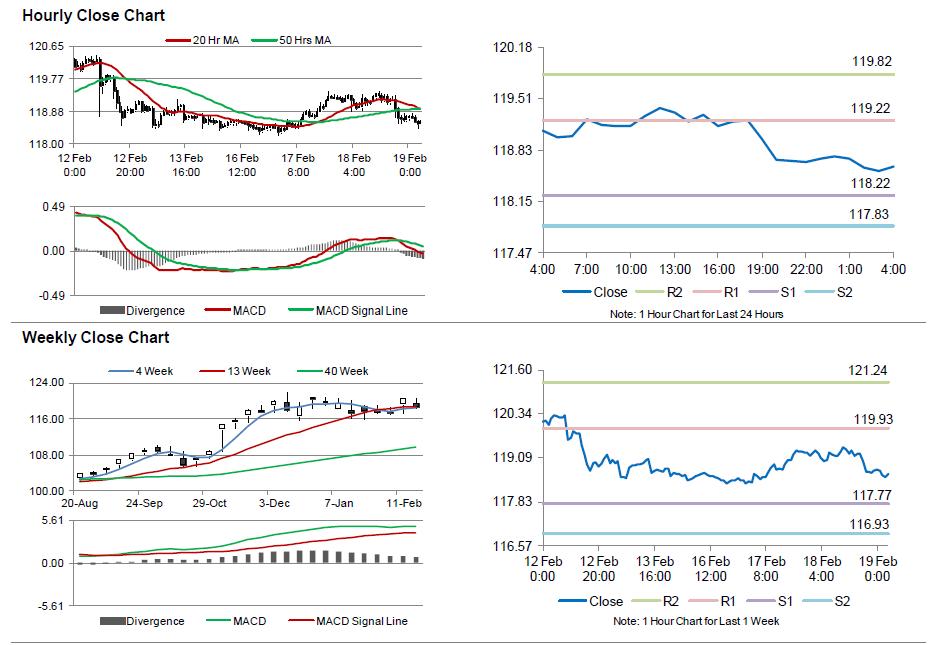

The pair is expected to find support at 118.22, and a fall through could take it to the next support level of 117.83. The pair is expected to find its first resistance at 119.22, and a rise through could take it to the next resistance level of 119.82.

Going forward, investors would closely monitor Japan’s manufacturing PMI data, scheduled in the early hours tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.