On Friday, the USD strengthened 1.34% against the JPY and closed at 119.08.

In the Asian session, at GMT0400, the pair is trading at 118.78, with the USD trading 0.25% lower from Friday’s close.

Japan’s consumer confidence index improved to 39.1 in January, compared to prior month’s level of 38.8. Markets were expecting it to rise to a reading of 39.3.

Earlier today, the BoJ’s Board Member Yoshihisa Morimoto stated that he expects consumer inflation to be lower in the near term on account of falling oil prices. Further, he stated that the inflation was expected to pick up following a temporary slowdown, as the economy recovers on the back of rise in exports and output.

Overnight data showed that Japan’s adjusted (total) current account surplus expanded more than expected to ¥976.60 billion in December, compared to a surplus of ¥914.50 billion recorded in the previous month. Market expectations were for it to increase to ¥940.80 billion.

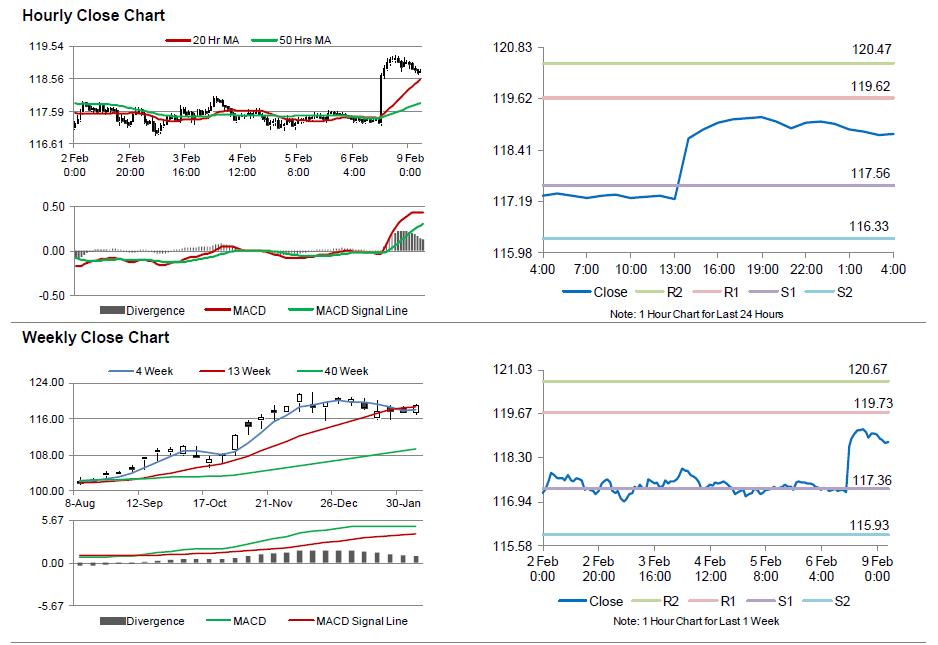

The pair is expected to find support at 117.56, and a fall through could take it to the next support level of 116.33. The pair is expected to find its first resistance at 119.62, and a rise through could take it to the next resistance level of 120.47.

Going forward, market participants would concentrate on Japan’s tertiary industry index data, scheduled overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.